How Ethereum NFTs Could Provide a Safe Haven From Crypto Market Volatility

The crypto market is (and always has been) noticeably volatile. This isn’t new information. Considering the fact that crypto prices are influenced directly by supply and demand, investor sentiments, government regulations, and more (including Elon Musk’s tweets), traders have continued close study of the market in hopes of maximizing gain and minimizing loss.

But when it comes to the NFT market, it’s an entirely different ballgame. Does this feel counterintuitive? Kind of. It would make sense if non-fungible tokens (NFTs) were inherently tied to crypto prices. Right?

Well, as the NFT ecosystem has grown and evolved, market researchers have become increasingly aware of a variety of new correlations. As it turns out, analytics company Nansen has found that some of our early assumptions about how crypto and NFTs coexist may be inconsistent with the 2022 NFT market.

Generally speaking, when the crypto market experiences a crash, it’s not uncommon for traders to sell off some of their stored crypto and free up liquidity. We’ve seen this happen often in the NFT market as well. Prices go down and NFT sales stall.

But now, Nansen has found that the NFT and crypto markets may not be correlated in the way that capitulation may suggest. With the release of six new indexes used for tracking the broader NFT market, the analytics company has found that NFTs may actually be inversely correlated to the crypto market.

What are the implications of this? Can NFTs actually provide a safe haven for crypto market volatility? At this point in the NFT ecosystem, it seems that they quite possibly could. Here’s why.

NFTs are performing better than most cryptocurrencies

First off, let’s explain that inverse correlation bit. An inverse correlation (or negative correlation) is a contrary relationship between two variables. This means when the value of Variable A is high, then the value of Variable B is most likely low.

How does this relate to NFTs vs. the crypto market? In short, NFTs are accruing gains while cryptocurrencies have generally seen losses so far this year.

With the information collected from their indexes, Nansen published a report that shows a sizeable difference between the performances of the NFT market and crypto markets. Essentially, Nansen has found that the NFT market has been outperforming the cryptocurrency market with a performance of 68.5% year-to-date (YTD) when denominated in ETH (20.9% YTD when denominated in USD).

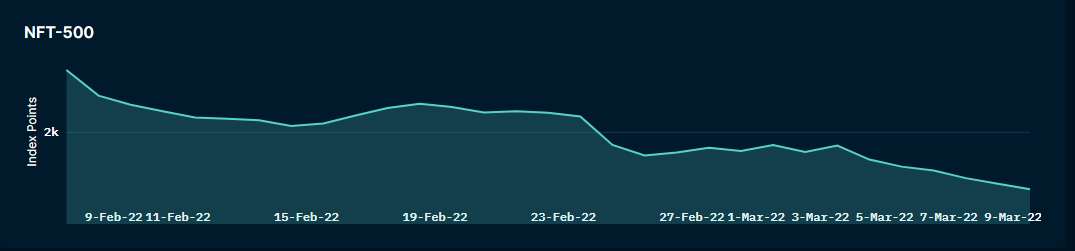

“While most markets have experienced a correction YTD, the NFT market has been outperforming the cryptocurrency market,” Nansen reports. The below chart helps reinforce this reporting by illustrating that NFTs (as indexed by Nansen’s NFT 500) have a -0.50 correlation coefficient with Ether and a -0.40 correlation with Bitcoin.

When measuring coefficients, positive numbers represent positive correlations and negatives indicate inverse. Entries with a 1 coefficient are neck and neck. When one moves, the other moves as well and in the same direction. Entries with a -1 are the opposite. When one is up, the other goes down and vice versa. Think of it in terms of magnets. Positive coefficients are attracted while negative ones are directly repelled.

“How is this all possible?” you may be wondering. Well, it may be due, in part, to the NFT ecosystem continuing to explode — bringing in over $23 billion in 2021 alone. And this hasn’t been a fleeting change either. While NFT sales took a significant dive towards the start of 2022, after such periods of intense growth, the world of NFTs is still growing exponentially.

Now that sales have been bolstered yet again going into Q2, it’s looking more and more likely that NFTs will continue to have a major impact on society for at least the next few years.

NFT and crypto investors are cut from different cloths

The people at the core of this NFT ecosystem expansion also need to be considered in this whole discussion over NFTs vs. crypto markets. Specifically, the types of people and institutions involved in crypto may vary greatly from those involved in the NFT space.

It seems that, for the most part, NFT traders are what are considered retail investors. Retail investors are basically just individual investors who invest for their own personal gain. Services like NFTSalesBot, which tells single tweet stories of sizeable flips, perfectly illustrate the “get rich quick” culture that has cropped up around NFTs.

Minting an NFT for a few hundred dollars and flipping it for hundreds of thousands (or even millions, h/t Bored Apes) in less than a year is an attractive gain — and one that just doesn’t happen in today’s crypto market. Yes, if you had invested the same amount into Bitcoin a decade ago it could’ve made for a similar story, but the crypto market growth seems long drawn out in comparison with the explosion of the NFT market.

We can also pair this sentiment with the fact that institutional investors — such as crypto investment funds, crypto exchanges, and even corporations — don’t seem overly eager to make the jump over to NFTs. These investors basically only purchase large supplies of crypto, giving them vast control over the market. When the crypto market moves, so do they, and vice versa.

Granted, we have seen entities like silicon valley investor Andreessen Horowitz (known in the NFT space as a16z) and FlamingoDAO stake their claims, purchasing vast quantities of popular NFTs, institutional investing just looks different in the NFT space.

NFTs may not be as volatile as once thought

Yes, NFTs are volatile. And when it comes to the most popular types of NFTs (a.k.a large-scale PFP projects), there’s truly no telling where prices may end up. Even worse, many projects turn out to be scams, serving to further the conversation around the viability of the NFT space in general.

But in 2022, NFT is at best just an umbrella term for the numerous different subsections of a newly established creative economy. We have to consider the whole, not just the popular or unsavory. Sports NFTs, 1/1 art NFTs, music NFTs, and PFP NFTs are all valued differently and act differently within the broader NFT market.

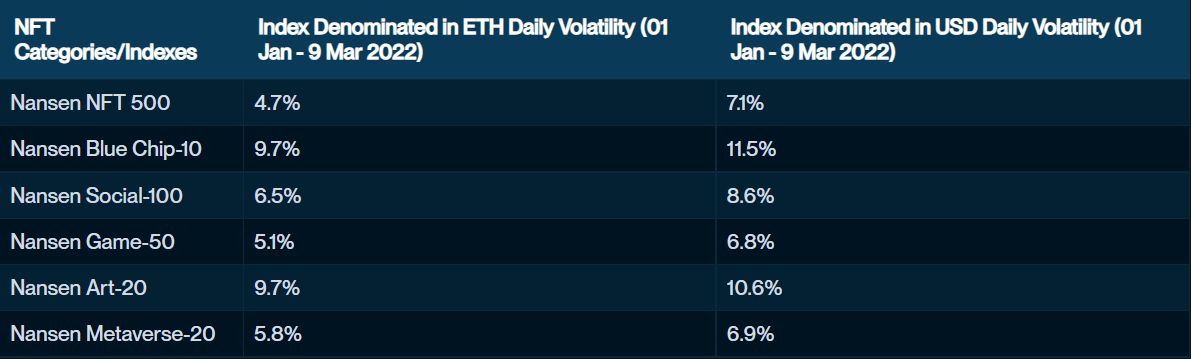

Take PFP NFTs (or Social NFTs as Nansen calls them) for example again. Overall, in terms of performance, social NFTs have been leading the pack. But in terms of volatility, they come in third after Blue Chip and Art NFTs.

Maybe unsurprisingly, volatility varies greatly depending on the variables. Essentially, the volatility of NFTs vs. NFTs looks much different than the volatility of NFTs vs. Ether and even more different with ETH vs. ShibaCoin.

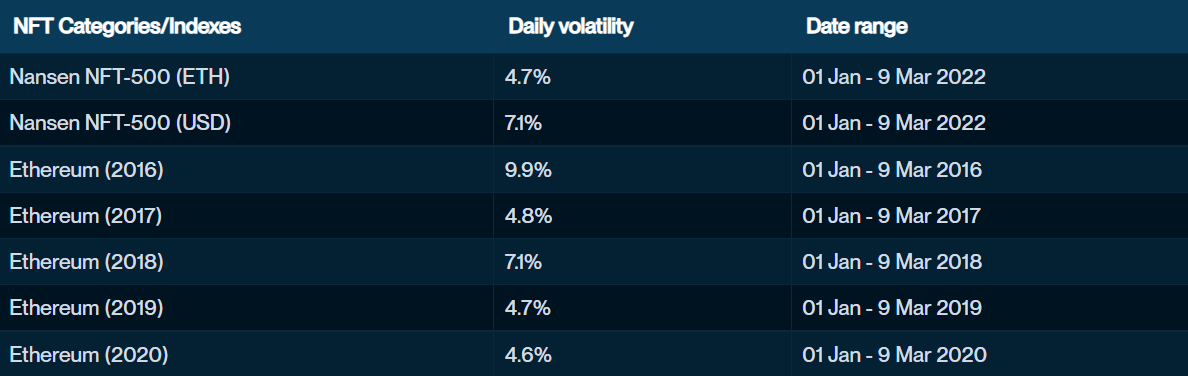

If we zoom out and look at the whole picture here, NFTs seem to currently be just as volatile as say, Ethereum. That might come as a bit of a shock to most, but consider this: the price action of Ethereum in 2016 was more volatile than the current NFT market.

The argument that NFTs are vastly more volatile than other major coins seems to be becoming weaker as time passes.

So what does it all mean?

Can NFTs provide a safe haven for crypto market volatility? Nansen’s data definitely seems to suggest so. Considering the palpable inverse correlation between NFTs and ETH, it might be safe to say that when ETH is crashing, NFTs can retain a decent percentage of their value and performance over time in response.

Of course, this isn’t to say that any old NFT will act the same. There are nuances to every subsection and every NFT collection out there. NFTs are still a relatively new asset class, and past performance could turn out to be an insufficient means of measurement down the line. After all, crypto charts, for better or for worse, are all rollercoasters themselves.

The post How Ethereum NFTs Could Provide a Safe Haven From Crypto Market Volatility appeared first on nft now.