Ethereum Merge: Here’s What to Expect From the Groundbreaking Move

The mythical merge is finally coming to fruition. And, after a rough-and-tumble year for the crypto world, Ethereum’s long-awaited software update could inject some much-needed energy into the Web3 space while scoring a significant win for the environment.

The transition, years in the making, is technically sophisticated, controversial, and likely to be the biggest event in the crypto space for some time to come. So, let’s break down what the merge is, why it’s essential, and what it means for the future of the crypto and NFT space.

What exactly is the merge?

The Ethereum blockchain is the technical infrastructure that allows countless Web3 applications and crypto and NFT projects to exist. At its most basic level, the merge (sometimes called Ethereum 2.0, Eth 2, or ETH 2.0) is an upgrade to the Ethereum blockchain that will reduce its environmental impact, increase security in the network, and enable Ethereum developers to introduce new features and increase the scalability of the chain.

So, what’s merging, exactly? The update will combine the Ethereum mainnet (blockchain) with the Beacon Chain, a separate blockchain created in 2020 that has since been running in parallel with Ethereum.

The Ethereum mainnet is what developers call the execution layer in the blockchain network. Execution layers create a place for applications to live and process transactions that relate to those applications. You can think of this as the engineering that allows for data transfers on the blockchain to take place. Execution layers give you the power to conduct a transaction.

The Beacon Chain is the consensus layer in the system. The secret’s in the name — this layer deals with network rule enforcement, validating (or invalidating) transactions that “want” to occur in the execution layer. Because blockchains are essentially decentralized public ledgers, they need a way to verify or invalidate the transactions taking place within them.

To do this while also ensuring that nobody forges a transaction on that public ledger and steals cryptocurrencies or NFTs that don’t belong to them, most computers in the system have to agree on the transaction’s (block’s) validity. This is how a blockchain governs itself without third parties.

Right now, the Ethereum mainnet uses a system called Proof of Work to validate transactions. Merging with the Beach Chain will allow Ethereum to end its PoW consensus system in favor of another system called Proof of Stake. And that’s a huge deal.

What’s proof of work?

Proof of Work is one of the main reasons why blockchain technology has a less-than-stellar environmental reputation. Together, the Bitcoin and Ethereum blockchains use more than 317 TWh hours of energy annually, which places them squarely between Italy and the United Kingdom in terms of electrical energy consumption.

This massive energy consumption comes from the PoW consensus mechanism involving complicated and energy-intensive computation, a process known as “mining.” To perform this mining, nodes in the network — which often take the form of giant servers that can span entire warehouses — solve complex mathematical problems based on cryptographic algorithms.

The process is energy-intensive by design. Requiring resource-heavy computing processes to try to mess around with the ledger disincentivizes people from doing so.

And how is proof of stake different?

Proof-of-stake consensus, which the Beacon Chain will bring to Ethereum, is orders of magnitude less energy-intensive than PoW — 99.95 percent less intensive. That’s because PoS doesn’t require nodes in the network to solve complex calculations. Instead, it ensures network security by having users stake an amount of their cryptocurrency in hopes that the system will randomly choose them as a block validator.

Why the merge matters

Along with Bitcoin, Ethereum is one of the most popular blockchains in the world, with a market cap of nearly $190 billion as of writing. Aside from the millions of NFTs the blockchain authenticates, innumerable other decentralized apps and decentralized financial systems depend on the blockchain to function.

The blockchain also symbolizes the crypto and NFT movement and Web3 in general. A successful merge could be a sorely needed shot in the arm to an ecosystem that is weathering yet another crypto winter. But, while many see the merge as a big win for Ethereum and its environmental impact, not everyone is happy about it. The switch will directly affect the countless ETH miners worldwide who earn cryptocurrency for performing PoW calculations. The merge will essentially eliminate the need for their existence (along with their bottom line).

There is also some ideological controversy surrounding the merge’s effects on the decentralized nature of Ethereum. Several well-known Web3 entities — including Lido, Coinbase, Kraken, and Binance — control large percentages of staked ETH on the Beacon Chain, leading some to fear that they could become targets of censorship attempts by government agencies.

Ethereum Founder Vitalik Buterin has indicated that he would support measures to burn the stake of any validators that censor Ethereum’s protocol at the behest of regulatory bodies, but the concern remains.

Another issue is what’s known as the 51 percent attack scenario, a hypothetical situation in which malicious actors collude to take over more than half of the validators in the network to forge the blockchain record and steal crypto or NFTs. Doing this would be incredibly difficult, since a hacker would need to own the majority of staked ETH in the system to do so, which would be prohibitively expensive to acquire.

How will the merge affect gas fees?

In a nutshell, it won’t.

Gas fees are the cost of conducting a transaction on Ethereum, and they can skyrocket during busy periods (like when an NFT project is minting), potentially adding hundreds of dollars to transaction costs. Unsurprisingly, Ethereum users aren’t so fond of this. However, the merge doesn’t affect the network’s capacity, so users won’t see a change in this dynamic after the merge is complete.

The technical miracle behind the merge

In April, Cooper Kunz, CTO at Calaxy, a Web3 social marketplace, described the merge as “one of the most difficult, novel, and impressive feats of engineering I think the world has ever seen,” in an interview with nft now.

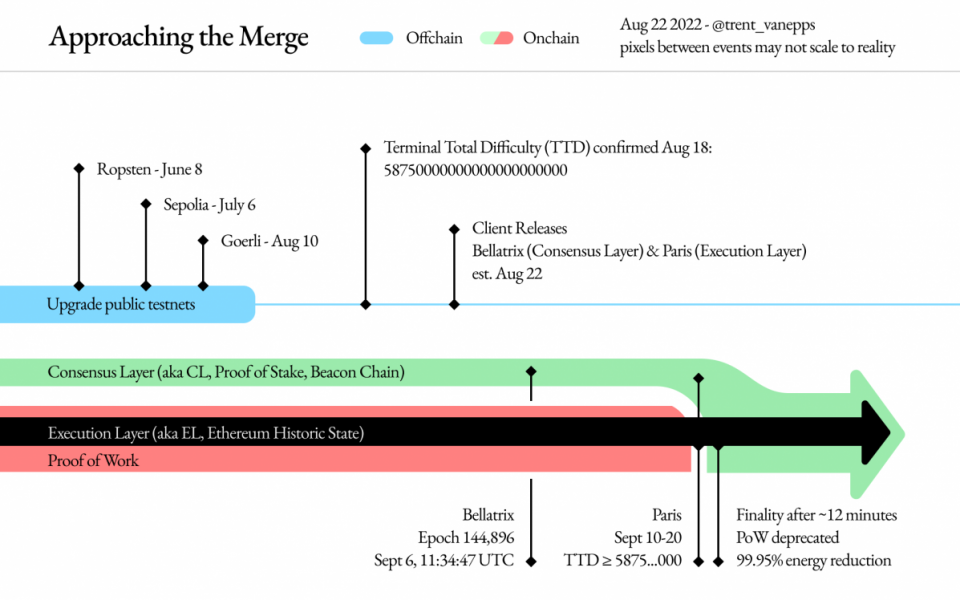

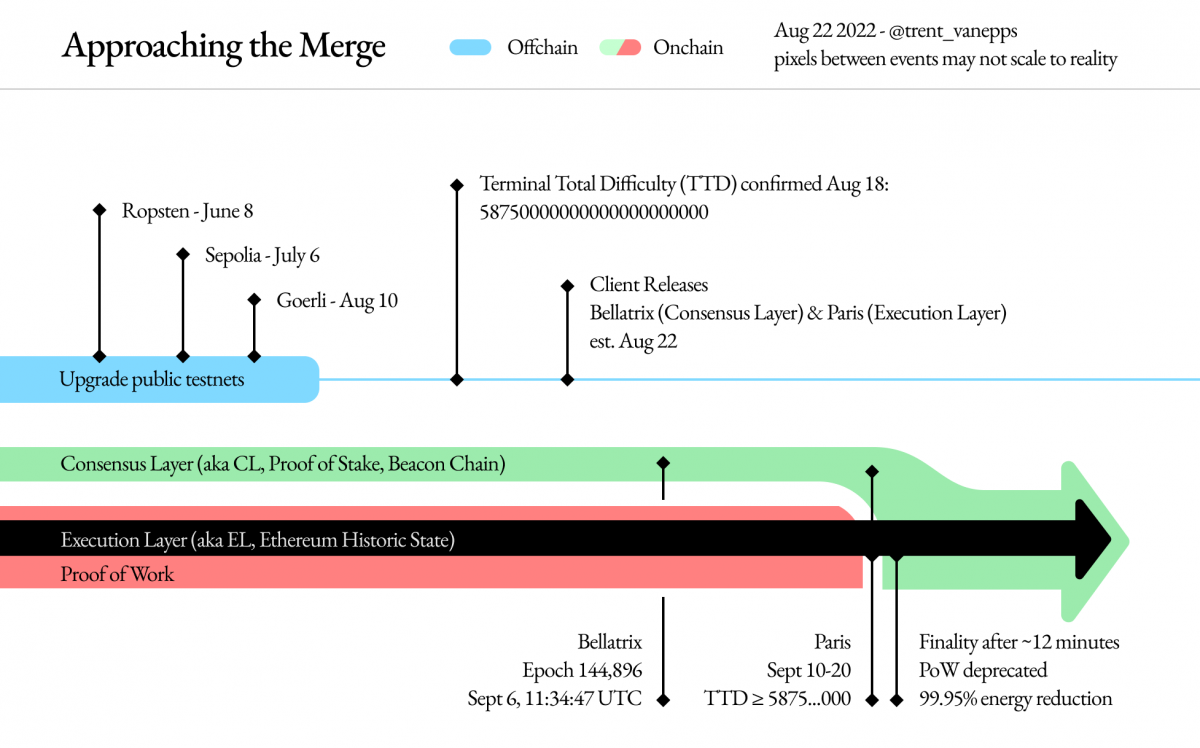

He’s not exaggerating. Ethereum developers have been hard at work at the merge for years, delaying it multiple times in the process. To pull off a switch of this magnitude, engineers have been conducting dress rehearsals for the merge in recent months involving several Ethereum test networks (testnets) to look for bugs or hiccups in the transition process. The most recent of these tests, which took place on the Goerli testnet, successfully merged earlier this month.

Two significant upgrades must also take place before the merge happens. First is the Bellatrix upgrade, which activates the merge on the Beacon Chain, followed by the Paris upgrade, which removes any dependency on proof-of-work mining.

When is the merge?

If all goes smoothly, Ethereum developers expect the merge to take place during the week of September 15, 2022. That’s not a guarantee, however, and given how long it has taken for the merge to come this far, it wouldn’t be a big surprise if the Ethereum team delayed it even more.

Still, it’s an exciting time to be in the crypto and NFT space. With any luck, the merge will go off without a hitch, and the Web3 community will have all the more reason to celebrate and promote a positive environmental message within and without its ranks.

The post Ethereum Merge: Here’s What to Expect From the Groundbreaking Move appeared first on nft now.