NFT Drops and Flops: A Definitive Guide to Diverse Mechanics

Choosing the proper drop structure is one of the most critical decisions for an NFT project founder. Not only can it make or break your launch from a financial perspective, but it also can serve as a leading indicator of your team’s preparedness, competence, and ability to handle the unexpected.

Because, let’s face it: NFT drops aren’t perfect. Adidas’ Into the Metaverse public drop left minters with astronomically high gas fees and a sour taste in their mouths as bots swooped up a significant amount of the supply. The CloneX Dutch auction suffered hacks, bots, and dishonest community members’ front-running trades. The first TimePieces drop had a 96% failure ratio due to a contract leak before the mint.

Each method comes with its own set of advantages and disadvantages, and unfortunately, there still isn’t (and may never be) a single method that will leave the entire community happy. But that doesn’t mean you can’t strive for it.

So we’re introducing different mechanisms for NFT drops, and highlighting the pros and cons of each, without failing to include the sharp opinions of experts keen on the space.

FCFS Public Mint

How it Works:

While the simplest, first-come, first-served (FCFS) public mints are also the most chaotic of all NFT drops. As the name suggests, FCFS drops are open, and public minting sessions are set at a predetermined time. From there, it’s a dog-eat-dog race to minting, where all interested collectors will try to mint at once. While some projects will limit how many NFTs a single wallet owner can purchase to discourage flipping and ensure a fair amount of unique users, others are a complete free-for-all. All FCFS mint prices are fixed (often somewhere between the .08 ETH and .2 ETH range), but for highly anticipated mints, collectors generally end up paying significantly higher gas fees due to the increased network congestion.

Pros & Cons:

Of course, with urgency and scarcity comes FOMO. And FOMO drives demand. Many well-planned FCFS public mints can sell out rather quickly, drumming up further hype around a project. If developers can prevent bots, FCFS mints also serve as one of the more fair ways of minting, allowing everyone to get an equal shot at securing an NFT.

But while the urgency of FCFS public mints can be an excellent way to drive demand, it’s essential to have your smart contracts rock-solid, from both a gas efficiency and bot-prevention perspective. Gas wars — or drastic spikes in gas fees due to network congestion — are a huge pain point for all highly anticipated FCFS mints. Since only the earliest buyers can successfully mint an NFT before the collection sells out, many others are left with failed transactions and lost fees.

Doing It Right

However, it’s crucial to be prepared for pushback from those who were unable to mint, were forced to pay exorbitant gas fees, or lost gas fees in failed transactions. These things are sadly inevitable. Not to mention the countless users who will try to deploy bots to mass-mint out collections, only to flip most of the NFTs moments later.

Whitelist + Public Mint

How It Works

Deploying a similar approach as the FCFS mint, the Whitelist and Public Mint combo has become the de facto standard of NFT drops.

A whitelist (also known as allowlist or starlist) is an exclusive list of users who have access to a project’s presale, which generally takes place from 24 to 72 hours before the public sale.

So how do you secure a whitelist spot and avoid all the commotion? First, be an active member of the project’s community. Leading up to a presale and public mint, most projects will reward active Discord users with whitelist spots based on engagement such as chat frequency, spreading the word about the project, or doing something kind for someone in the community. Many projects will also hold giveaways either in their own Discord, or in the Discords of other projects, to drum up hype around the launch.

Pros & Cons

While presale prices are generally lower than public mint sale prices, securing a whitelist spot has one big advantage: No gas wars. Whitelists also allow community members who are truly passionate about the project to secure their ability to mint stress-free.

But while the public mint portion carries the same downsides of gas wars and bots, whitelists come with a separate slate of risks. Often, members of Discord communities will engage heavily until they earn a whitelist spot, and then fall off the map, only to quickly flip their NFT after mint. While this is far from illegal, it’s essential to try to identify and reward those who engage with your community for the right reasons.

Doing It Right

As a project founder, you ultimately want to build a community of holders who view your NFTs as a valuable piece of technology and art, rather than a speculative, quick-flip asset. While flipping is far from illegal, it’s crucial to try to identify those who engage with your community for the right reasons and reward them with whitelist spots.

Free Mint

How it Works

As the name suggests, free-to-mint NFTs are released to the public at no cost, outside of the gas fees. In the current bear market, where liquidity and funds are low, free mints have emerged as a formidable drop option for many project founders. Choosing to forego the upfront capital from primary sale earnings, founders who opt for free mints mainly drive revenue from the secondary royalties on all collection sales.

Perhaps the most recognizable and noteworthy free mint is Goblintown, which paved the way for projects like Moonrunners and Saudis. The erstwhile-anonymous brainchild of Truth Labs, Goblintown boasts one of the most loyal and committed communities in NFTs.

Pros & Cons

On the one hand, this is a positive development in the industry, since it significantly reduces a significant barrier to entry for the masses: price. It also requires projects to be thoughtful, diligent, and committed to delivering true value to their holders. From a founder standpoint, if the project is a dud and fails to take action towards its roadmap, then trade volume (and founder income) will also suffer.

But separately, when directed by bad actors, free mints can also do serious harm. As free mints have become more normalized, there has been an uptick in “free mint scams,” where traders think they are minting a free NFT, but are instead connecting their wallet to a faulty smart contract that automatically drains users’ wallets upon transaction approval. According to PREMINT Founder Brendan Mulligan, this has become an industry problem.

Doing It Right:

Most founders will release free mints for the right reasons, and this should go without saying, but do not rug or scam your community.

Dutch Auction

How It Works

While many NFT projects operate with fixed mint prices, others (especially in the art world) opt for auction-style listings. And while English auctions (think eBay or traditional bidding at an auction house) are fairly straightforward, Dutch auctions are a bit more complicated.

A Dutch auction is a bidding technique that uses a declining price format, first arriving at a ceiling price and then gradually dropping the price at specific time intervals until it hits the lowest price it will go (resting price). The auction ends when the collection is either sold out or reaches the resting price.

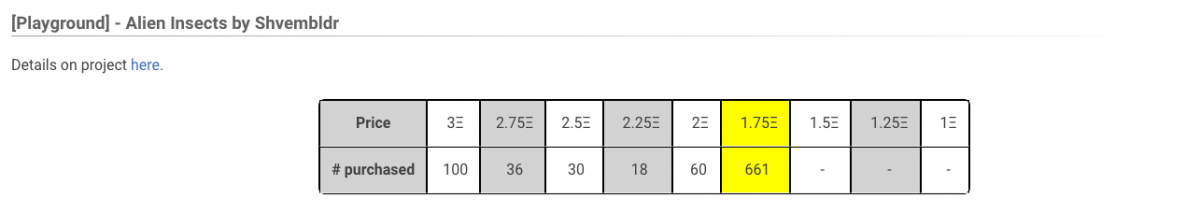

Let’s consider Shvembldr’s Alien Insects which was released under the ArtBlocks Playground collection. A total of 1,000 Alien Insects were sold via Dutch auction with a starting price of 3 ETH, which was reduced by 0.25 ETH every 5 minutes. Here is the progression of the drop.

Pros & Cons of Dutch Auctions

The biggest advantage of Dutch auctions is their ability to prevent gas wars by staggering demand. But there’s also a community component. With standard public mints, nearly all of the exorbitant gas fees go to the miners’ pockets, explained Art Blocks Founder and CEO Erick Calderon in a past Discord post. With Dutch auctions, many artists donate a portion of their proceeds to charities or community DAOs, which can incentivize collectors’ willingness to pay more for a project.

But while good in theory and intent, Dutch auctions don’t always run smoothly. Ahead of their Otherdeeds drop titled Dutch Auctions are actually bullshit, arguing (after launching multiple Dutch auctions of their own) that the drop method fails to successfully mediate demand or negate gas wars. Unfortunately, the Otherdeeds drop didn’t seem to fix the problems either, with an inefficient smart contract contributing to the burning of a collective 64,000 in ETH ($175 million at the time of mint) in roughly 24 hours.

Other community members, like Purrnelope’s Country Club founder and previous NFTBOXES co-founder Carlini, argue that Dutch auctions hurt the biggest fans of a project who are first buyers but end up with a higher bill. To combat this, certain drops like The Writer’s Room Azurbala automatically refund minters the difference between their initial mint and the clearing price.

Doing It Right

Ultimately, community response to Dutch auctions is always a mixed bag. But there is one move that everyone who participates in a Dutch auction appreciates: Refunding the difference between the initial mint and clearing price.

Token-Gated Presale + Public Sale

How It Works:

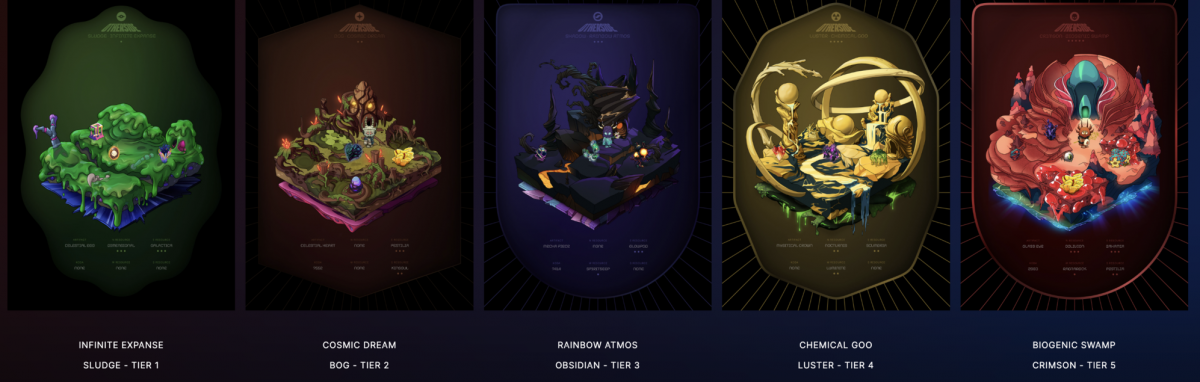

Similar to whitelists, token-gated presales are presale drops that are limited exclusively to NFT holders of a specific community (or communities). A perfect example of this is the Illuminati NFT drop which launched in three phases, each phase granting access to various prominent NFT communities.

Token-gated post-sales are also common, allowing token holders to claim their NFTs for a set period after the public sale, without the time sensitivity or crazy gas prices. Otherdeeds, perhaps the most anticipated launch of the year, allowed all BAYC and MAYC holders to claim NFTs for 21 days after the public sale. For those interested in flipping, it also allows them to see how the project performs before claiming.

Pros & Cons

Token-gating is a great way to reward existing community members for their support and encourage new members to join your community. However, many, if not all, of the downsides of public mints are still active here.

Doing It Right

Instead of standard whitelist spots that can be gamed, sold, and farmed for engagement, token-gating ensures that your true fans (or the fans of your partners) can remain part of your project’s expansion. As a founder, driving value for your community should stay at the forefront of every decision you make.

Smart Batch Auction

How It Works:

Smart batch auctions are one of the newest, most innovative forms of NFT drops designed to mitigate gas wars and network congestion. In this scenario, as outlined by FrankieIsLost, users can submit bids to a smart contract specifying their desired purchase price and amount of tokens within a set bidding period. Once the bidding period concludes, a clearing price is calculated to match demand and supply. Those who bid above the clearing price receive the NFTs and are refunded the difference between their bid and the clearing price. Those who bid below the clearing price are refunded in full.

Pros & Cons

While we haven’t seen too many Smart batch auctions yet in the wild, it’s definitely an exciting concept for founders and developers to explore. And while Smart Batch Auctions may solve common issues around gas wars and network congestion, their impact is far from proven. Given the stage of this idea, there is likely a learning curve for prospective minters that may dissuade people from minting in an already soft market.

Doing It Right:

As with any innovation, make sure to do your research, and expect ample feedback from your community.

All in all, there’s no right way to drop your NFTs, but there is a right way to execute on whichever method you choose. Consider which structure will be most beneficial to your community, deliver the best user experience, and execute relentlessly. Remember, your drop is the first touchpoint for many prospective and future holders. The last thing you want to do is start on a sour note.

The post NFT Drops and Flops: A Definitive Guide to Diverse Mechanics appeared first on nft now.