Decision Trees: A Simple Tool to Make Radically Better Decisions

Have you ever made a high-stakes decision? If yes, did you contemplate for some time before landing on the “right” decision — and even then, still felt unsure about the best course of action?

In cases like those, you might need a decision tree. It’s more formal than a chat with a friend or a pros-and-cons list.

Here, we’ll show you how to create a decision tree and analyze risk versus reward. We’ll also look at a few examples so you can see how other marketers have used decision trees to become better decision makers.

Table of Contents

How to Create a Decision Tree in Excel

When it comes to marketing, decision-making can feel particularly risky. What is my colleague is so attached to a new product, she doesn’t want to mention any of its shortcomings? What if my marketing team doesn’t mind office growth, but they haven’t considered how it will affect our strategy long-term?

The visual element of a decision tree helps you include more potential actions and outcomes than you might’ve if you just talked about it, mitigating risks of unforeseen consequences.

Plus, the diagram allows you to include smaller details and create a step-by-step plan, so once you choose your path, it’s already laid out for you to follow.

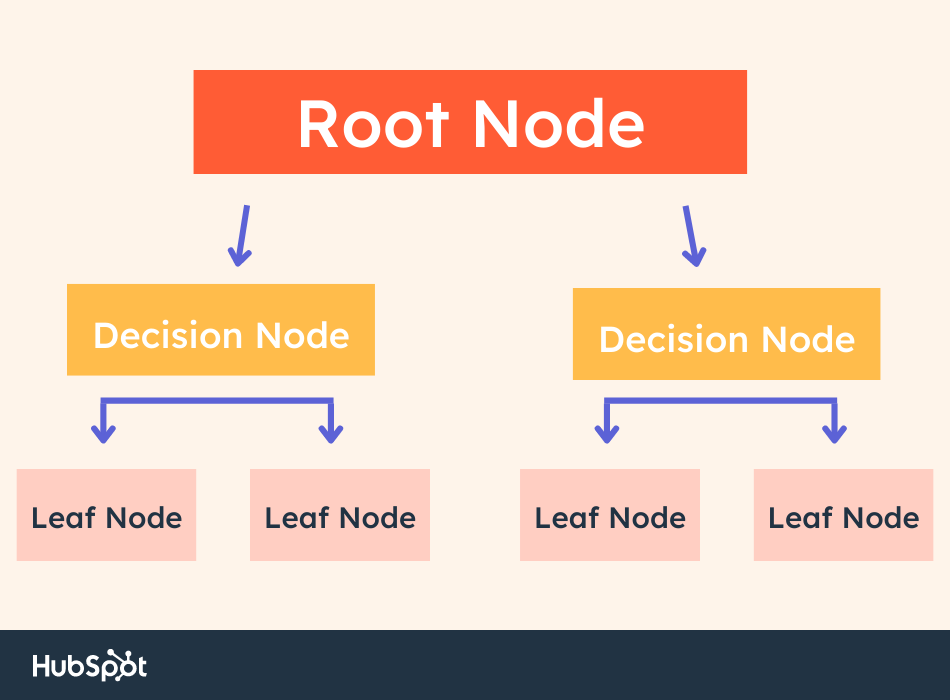

A decision tree contains four elements: the root node, decision nodes, leaf nodes, and branches that connect them together.

A decision tree contains four elements: the root node, decision nodes, leaf nodes, and branches that connect them together.

- The root node is where the tree starts. It’s the big issue or decision you are addressing.

- As the name suggests, the decision nodes represent a decision in your tree. They are possible avenues to “solve” your main problem.

- The lead nodes represent possible outcomes of a decision. For instance, if you’re deciding where to eat for lunch, a potential decision node is eat a hamburger at McDonald’s. A corresponding leaf node could be: Save money by spending less than $5.

- Branches are the arrows that connect each element in a decision tree. Follow the branches to understand the risks and rewards of each decision.

Now let’s explore how to read and analyze the decisions in the tree.

Decision Tree Analysis [Example]

Let’s say you’re deciding where to advertise your new campaign:

- On Facebook, using paid ads, or

- On Instagram, using influencer sponsorships.

For the sake of simplicity, we’ll assume both options appeal to your ideal demographic and make sense for your brand.

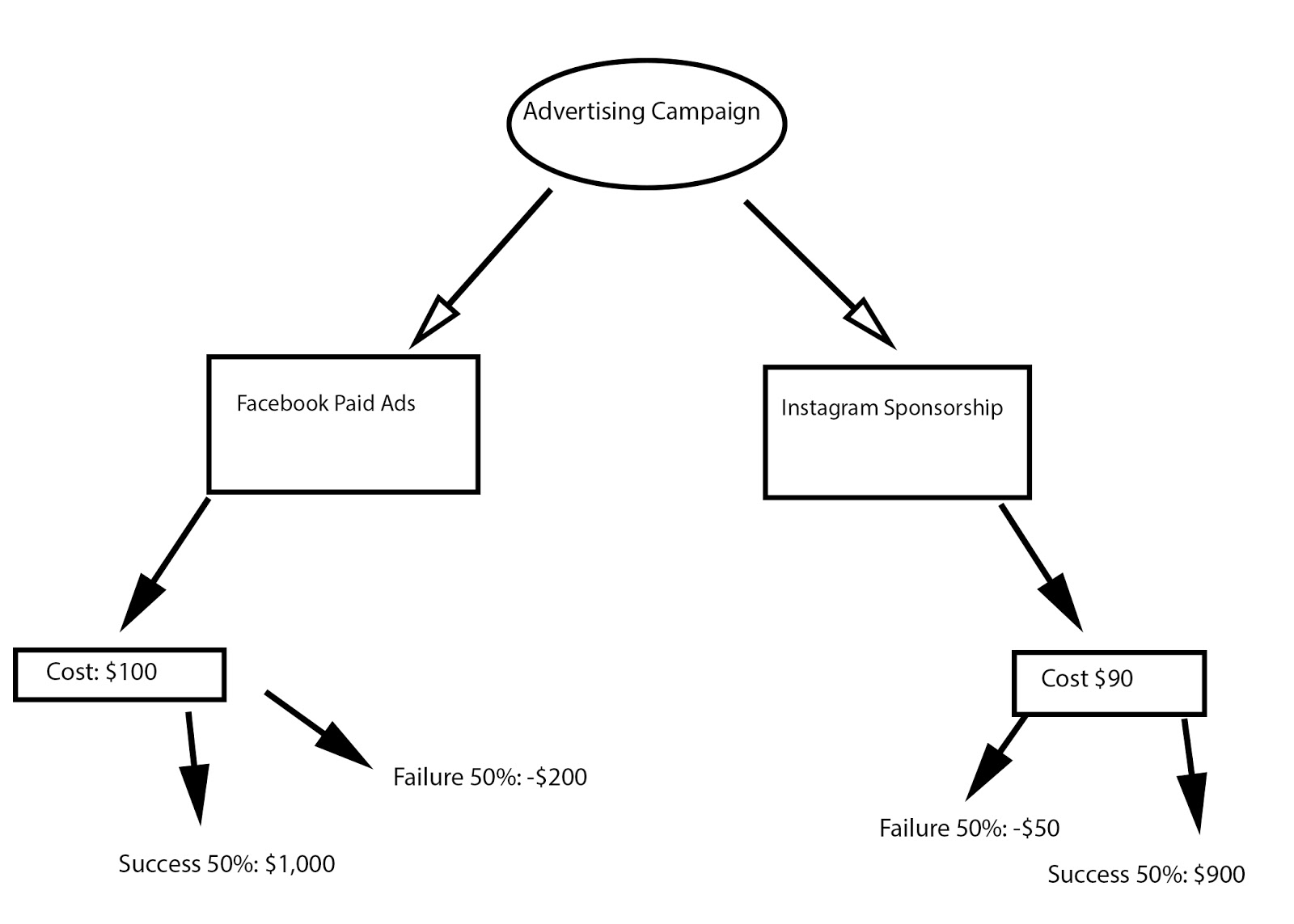

Here’s a preliminary decision tree you’d draw for your advertising campaign:

As you can see, you want to put your ultimate objective at the top — in this case, Advertising Campaign is the decision you need to make.

Next, you’ll need to draw arrows (your branches) to each potential action you could take (your leaves).

For our example, you only have two initial actions to take: Facebook Paid Ads, or Instagram Sponsorships. However, your tree might include multiple alternative options depending on the objective.

Now, you’ll want to draw branches and leaves to compare costs. If this were the final step, the decision would be obvious: Instagram costs $10 less, so you’d likely choose that.

However, that isn’t the final step. You need to figure out the odds for success versus failure. Depending on the complexity of your objective, you might examine existing data in the industry or from prior projects at your company, your team’s capabilities, budget, time-requirements, and predicted outcomes. You might also consider external circumstances that could affect success.

Evaluating Risk Versus Reward

In the Advertising Campaign example, there’s a 50% chance of success or failure for both Facebook and Instagram. If you succeed with Facebook, your ROI is around $1,000. If you fail, you risk losing $200.

Instagram, on the other hand, has an ROI of $900. If you fail, you risk losing $50.

To evaluate risk versus reward, you need to find out Expected Value for both avenues. Here’s how you’d figure out your Expected Value:

- Take your predicted success (50%) and multiply it by the potential amount of money earned ($1000 for Facebook). That’s 500.

- Then, take your predicted chance of failure (50%) and multiply it by the amount of money lost (-$200 for Facebook). That’s -100.

- Add those two numbers together. Using this formula, you’ll see Facebook’s Expected Value is 400, while Instagram’s Expected Value is 425.

With this predictive information, you should be able to make a better, more confident decision — in this case, it looks like Instagram is a better option. Even though Facebook has a higher ROI, Instagram has a higher Expected Value, and you risk losing less money.

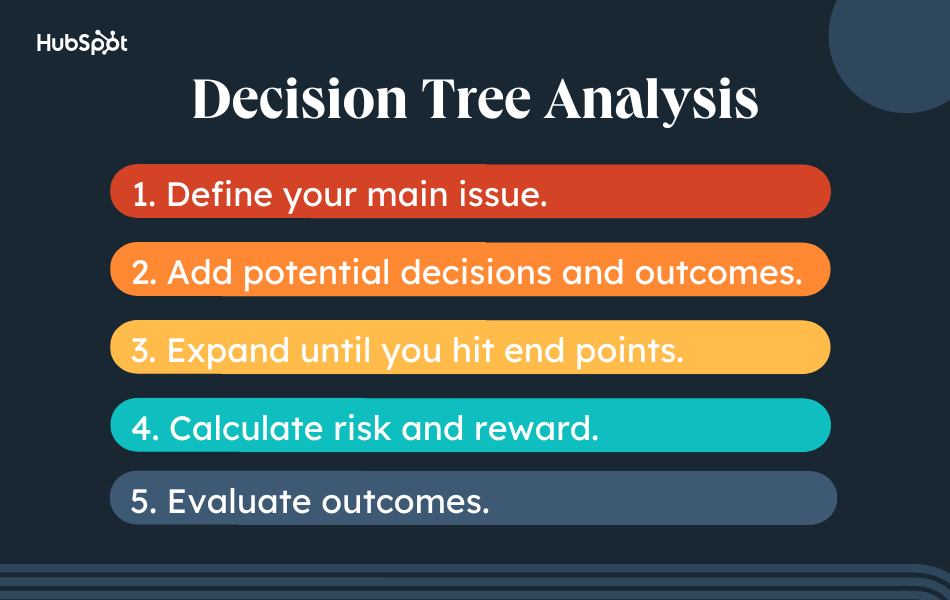

How to Create a Decision Tree

You can create a decision tree using the following steps. Remember: once you complete your tree, you can begin analyzing each decision to find the best course of action.

1. Define your main idea or question.

The first step is identifying your root node. This is the main issue, question, or idea you want to explore. Write your root node at the top of your flowchart.

2. Add potential decisions and outcomes.

Next, expand your tree by adding potential decisions. Connect these decisions to the root node with branches. From here, write the obvious and potential outcomes of each decision.

3. Expand until you hit end points.

Remember to flesh out each decision in your tree. Each decision should eventually hit an end point, ensuring all outcomes rise to the surface. In other words, there’s no room for surprises.

4. Calculate risk and reward.

Now it’s time to crunch the numbers.

The most effective decision trees incorporate quantitative data. This allows you to calculate the expected value of each decision. The most common data is monetary.

5. Evaluate outcomes.

The last step is evaluating outcomes. In this step, you are determining which decision is most ideal based on the amount of risk you’re willing to take. Remember, the highest-value decision may not be the best course of action. Why? Although it comes with a high reward, it may also bring a high level of risk.

It’s up to you — and your team — to determine the best outcome based on your budget, timeline, and other factors.

While the Advertising Campaign example had qualitative numbers to use as indicators of risk versus reward, your decision tree might be more subjective.

For instance, perhaps you’re deciding whether your small startup should merge with a bigger company. In this case, there could be math involved, but your decision tree might also include more quantitative questions, like: Does this company represent our brand values? Yes/No. Do our customers benefit from the merge? Yes/No.

To clarify this point, let’s take a look at some diverse decision tree examples.

Decision Tree Examples

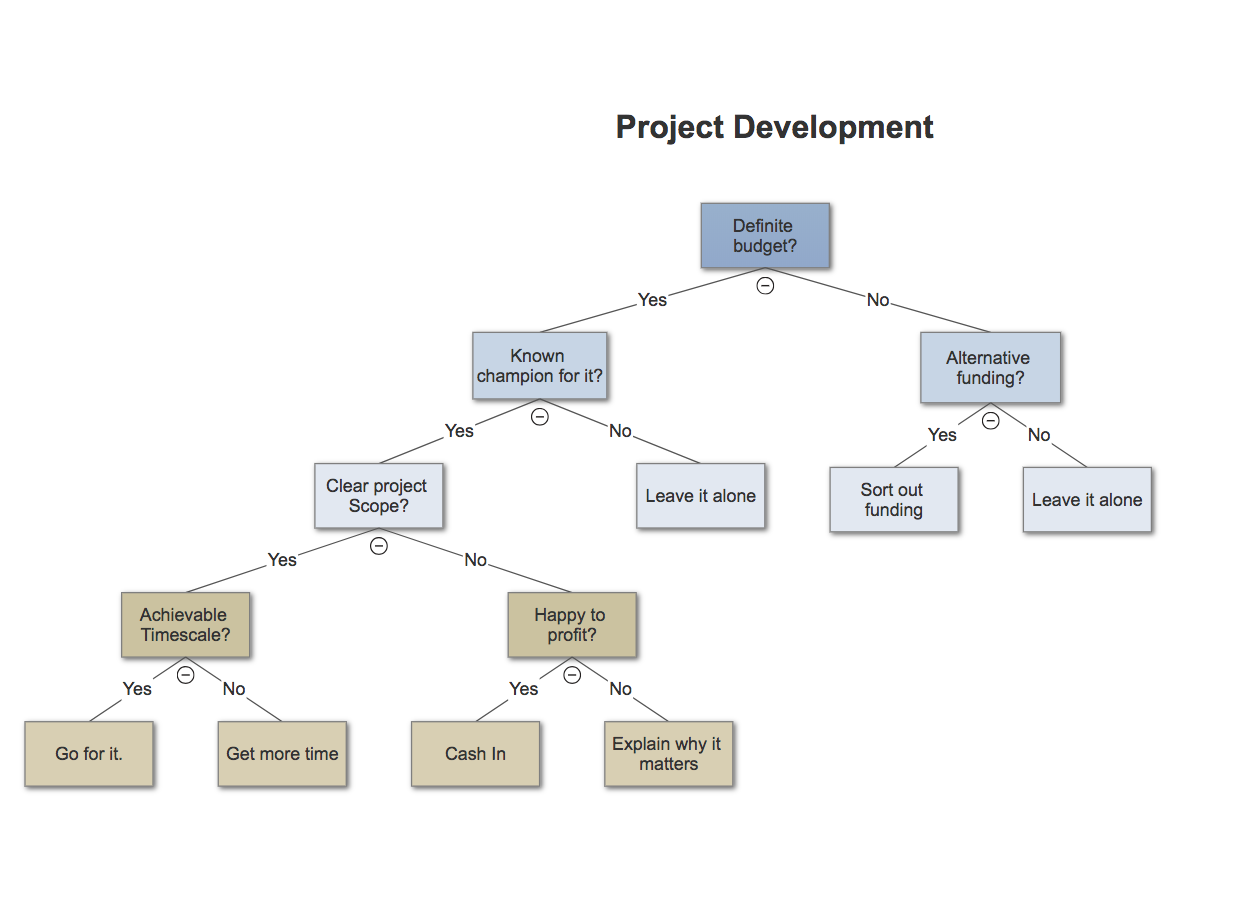

The following example is from SmartDraw, a free flowchart maker:

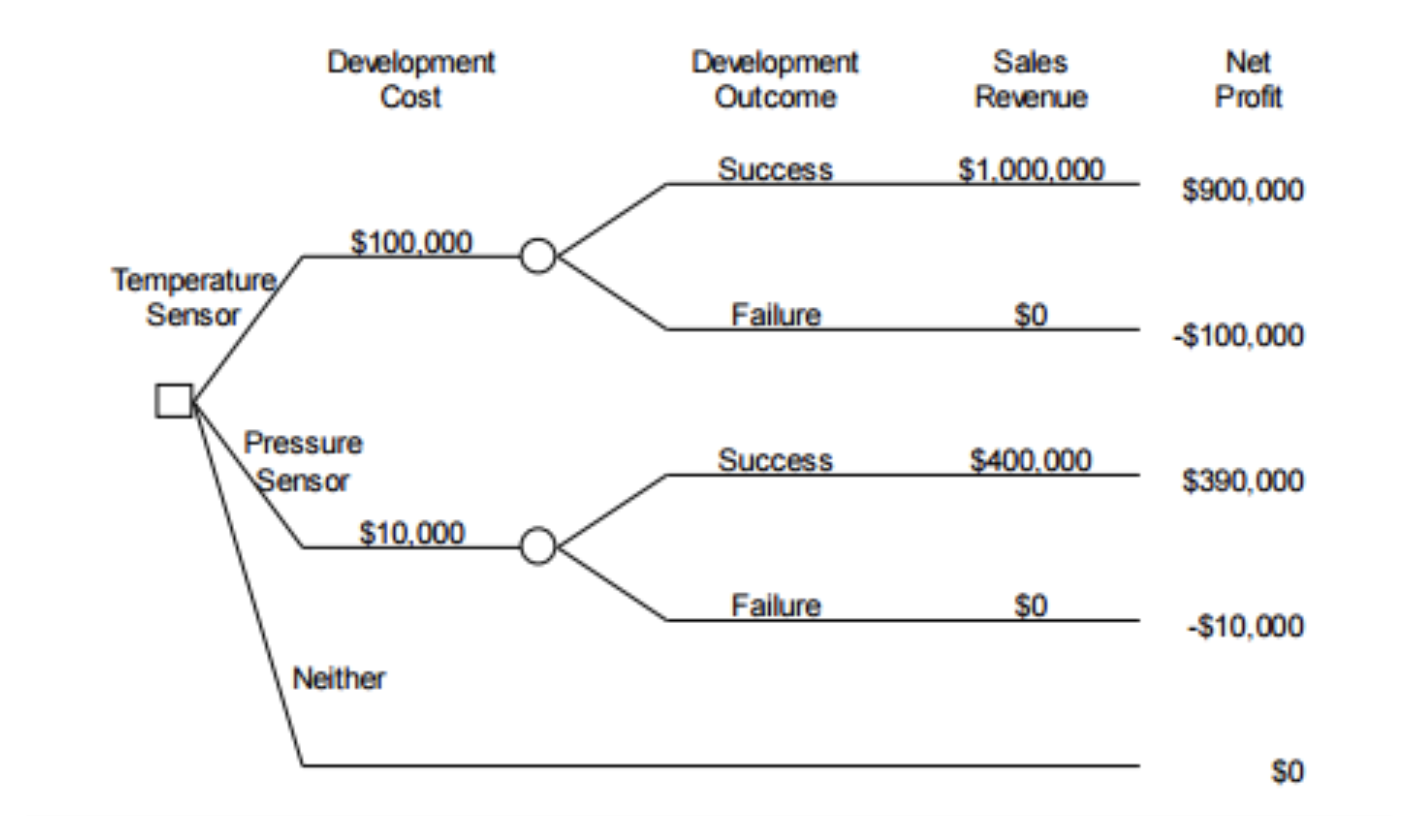

Example One: Project Development

Here’s another example from Become a Certified Project Manager blog:

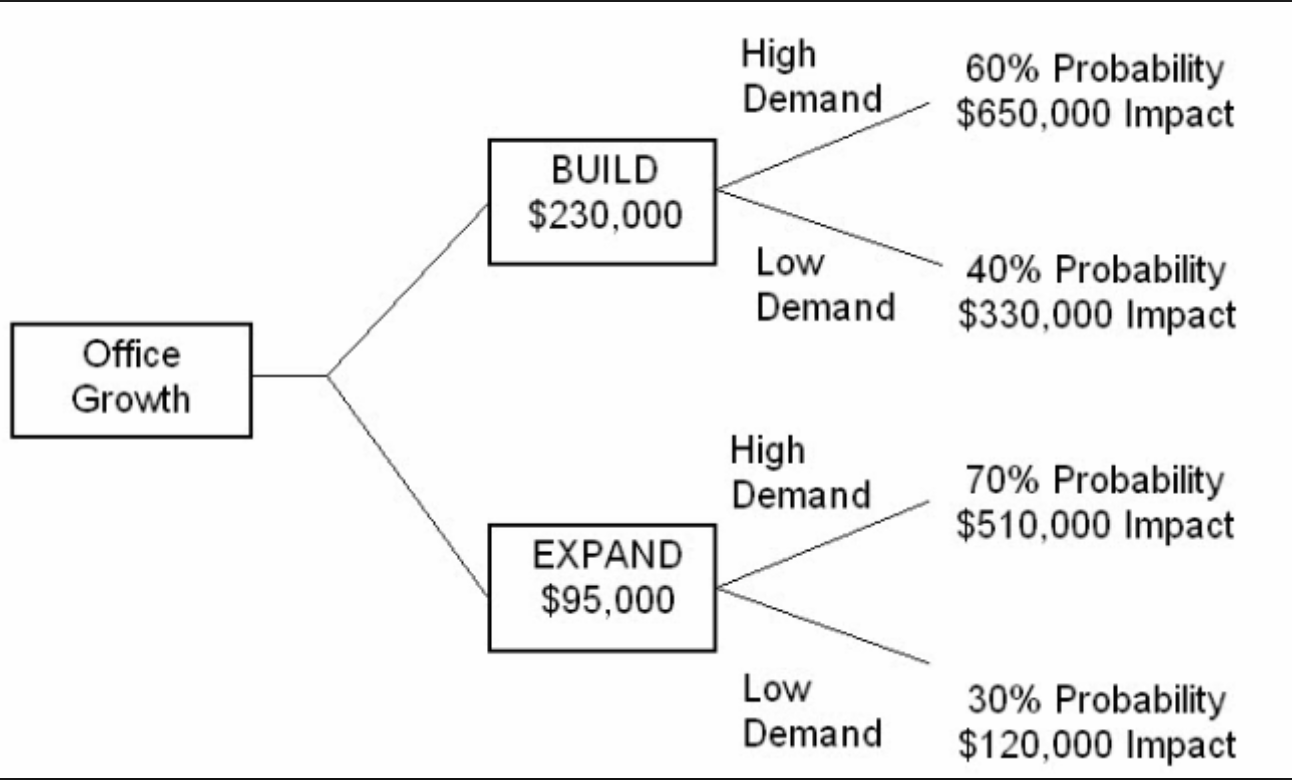

Example 2: Office Growth

Here’s an example from Statistics How To:

Example 3: Develop a New Product

To see more examples or use software to build your own decision tree, check out some of these resources:

- IBM SPSS Decision Trees

- LucidChart Decision Tree Software

- Zingtree Interactive Decision Tree Template

Back to You

Remember, one of the best perks of a decision tree is its flexibility. By visualizing different paths you might take, you might find a course of action you hadn’t considered before, or decide to merge paths to optimize your results.

![]()

![→ Access Now: 8 Business Flowchart Templates [Free Tool]](https://no-cache.hubspot.com/cta/default/53/46d3b1c7-3e3b-4386-b78e-8b57f6d95750.png)