Fact Check: Does Meta Actually Charge More Fees Than NFT Platforms?

Earlier this week, Meta made headlines when the company announced details about forthcoming tools for Horizon Worlds, a virtual reality video game created by the company. Meta is creating new features for the game that will enable creators to sell digital items and art. In a blog post published on April 11, the company revealed that it would be taking a cut of 47.5% from all sales.

First, they charge a “hardware platform fee” of 30% for any sales completed via the Meta Quest Store (a marketplace for VR-enabled apps and games). Second, there is a 17.5% fee that comes from Horizon Worlds itself.

This announcement ruffled more than a few feathers. It seems like another case of a major corporation with billions of dollars taking advantage of independent artists. Yet, sizeable fees aren’t new to those regularly interacting with the blockchain. Nearly every prominent NFT marketplace has a variety of fees, and many NFT marketplaces are also rolling in wealth.

So, is there really that big of a divide between Meta’s 47.5% cut and that of other marketplaces, all things considered? Are people right to be angry? Let’s explore.

Interacting with the blockchain costs money

This won’t be new information to most, but blockchain transactions always cost money. But how much money they cost depends on the blockchain and the type of transaction.

For example, Ethereum (like many other blockchains) charges fees to users when they conduct transactions — when they mint an NFT, swap coins, list NFTs for sale, and so on. These gas fees, as they’re called, are basically payments made by users to compensate for the computing energy required to process and validate transactions.

Ultimately, the gas fees vary from blockchain to blockchain because they all use different consensus mechanisms. But all this can get a bit technical and confusing, so we won’t get into the different consensus mechanisms and why some cost more and others cost less. To better serve this article, the fee amounts are what really matter.

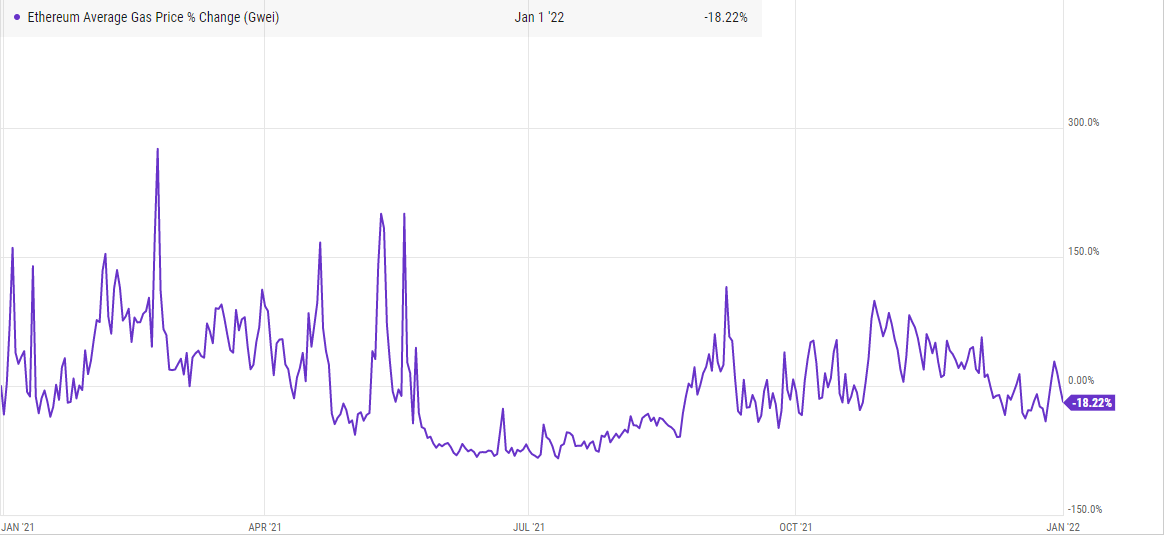

By and large, the Ethereum blockchain charges the most fees. In 2021, fees ranged from as low as $9 to as high as around $300 per transaction. Yet, Solana and Tezos, the second and third most popular NFT blockchains, regularly reported transaction fees amounting to just fractions of a dollar.

Yes, gas fees can become astronomically high on some blockchains. However, there’s no way to tell what percentage of the profits they equate to until an NFT sells. If an NFT sells for a lot of money and the gas fee was low, the gas fee may be less than 1% of the sale price. But let’s say an NFT sells for just $15 and the gas fee was $50. That means that the fees will be well over 100% of the earnings. And yes, this does happen.

However, these gas fees may not be the best thing to compare with Meta fees.

Blockchain gas fees don’t go to blockchain companies. Ethereum and Solana aren’t taking money from users and giving it to themselves. Rather, these gas fees go to other blockchain users who are verifying the transactions. Conversely, when a user sells an item on Horizon Worlds, Meta takes a cut. The money goes directly to its own companies. So, for a better comparison, we have to look at the actual act of trading NFTs — we have to take marketplace fees into consideration.

What’s the cost of trading NFTs?

Because of the way they structure their fees, we can tell, immediately, the amount that will be taken off the top by the marketplace in which an NFT is listed. Here’s the breakdown.

Zora: Zero fee platform. When minting an NFT, users just pay gas fees. They take no commission on sales.

LooksRare: No minting fee, users just pay gas fees. Takes 2% of every final sale price.

OpenSea: No minting fee, users just pay gas fees. Takes 2.5% of every final sale price.

Rarible: No minting fee, users just pay gas fees. Takes 2.5% of every final sale price.

SuperRare: No minting fee, users just pay gas fees. Takes 3% of every final sale price.

Foundation: No minting fee, users just pay gas fees. Takes 15% of every final sale prices

From these figures, it’s clear that Meta has higher fees than practically every NFT marketplace. A lot higher fees.

Which to choose: Meta or NFT marketplaces?

Despite the fact that the fees charged by NFT marketplaces are far, far lower than Meta’s fees, users might still prefer to sell their works with Meta. After all, when minting NFTs on the Ethereum blockchain, gas could likely end up costing $100. This could dissuade many who are aiming to profit off of their art, as most artists aren’t able to sell their works for that much. Yet, there generally isn’t this concern with blockchains like Solana and Tezos.

Also, there is something to be said about the ethics of it all.

The big difference between Meta’s forthcoming marketplace and established trading platforms is that Meta owns its whole ecosystem. The NFT ecosystem is one built on the ideology of decentralization, which is precisely why blockchain fees go to users. The users who verify transactions are literally the ones ensuring the system functions. That’s what real decentralization means. The NFT ecosystem also hosts many diverse options for creating and trading NFTs. Users can mint an NFT on one platform, and then they can view the NFT, list it, and sell it via another. What’s more, NFT marketplaces generally exist on a number of different blockchains. For example, OpenSea is the world’s largest NFT marketplace. It offers cross-blockchain support across Ethereum, Polygon, Solana, and Klatyn.

Interoperability like that will likely not exist in Meta. Meta’s metaverse will be contained entirely within the ecosystem that Meta owns and develops. And all the money will go to that company or the subsidiaries it owns.

The post Fact Check: Does Meta Actually Charge More Fees Than NFT Platforms? appeared first on nft now.