Looking for Liquidity? Here’s Everything to Know About NFT Lending

The last 24 months have been a whirlwind for NFT enthusiasts, with unprecedented demand for digital ownership creating a new and exciting asset class right before our eyes. But eventually, all new toys lose their shine. And after a crazy period of buying, selling, and trading NFTs, investors seek new ways to leverage their assets.

Enter the rise of fractionalized ownership, staking, and NFT’s hottest new sector: lending.

You read that right. People are lending their relatively-illiquid JPEGs for instant payouts in crypto and cash. And it’s become a massive sector of the market.

It’s finally time to break down the basics of NFT lending — how it really works, and the different types of lending models.

But first, a definition.

What is NFT lending?

NFT lending is the act of collateralizing your NFT as a loan in exchange for immediate crypto payment. And it solves the asset class’ most significant problem: liquidity. Relative to other asset classes, NFTs are relatively illiquid — meaning it’s not easy to quickly sell your NFT for its designated market value in cash (or cryptocurrency). In other words, it can take months for someone to buy your JPEG. Additionally, for investors with sizable investment allocations tied up in NFTs, quick access to liquid capital can sometimes be a tall order. Loans also provide NFT owners with a means to generate non-taxable income, as opposed to the tax implications of a sale.

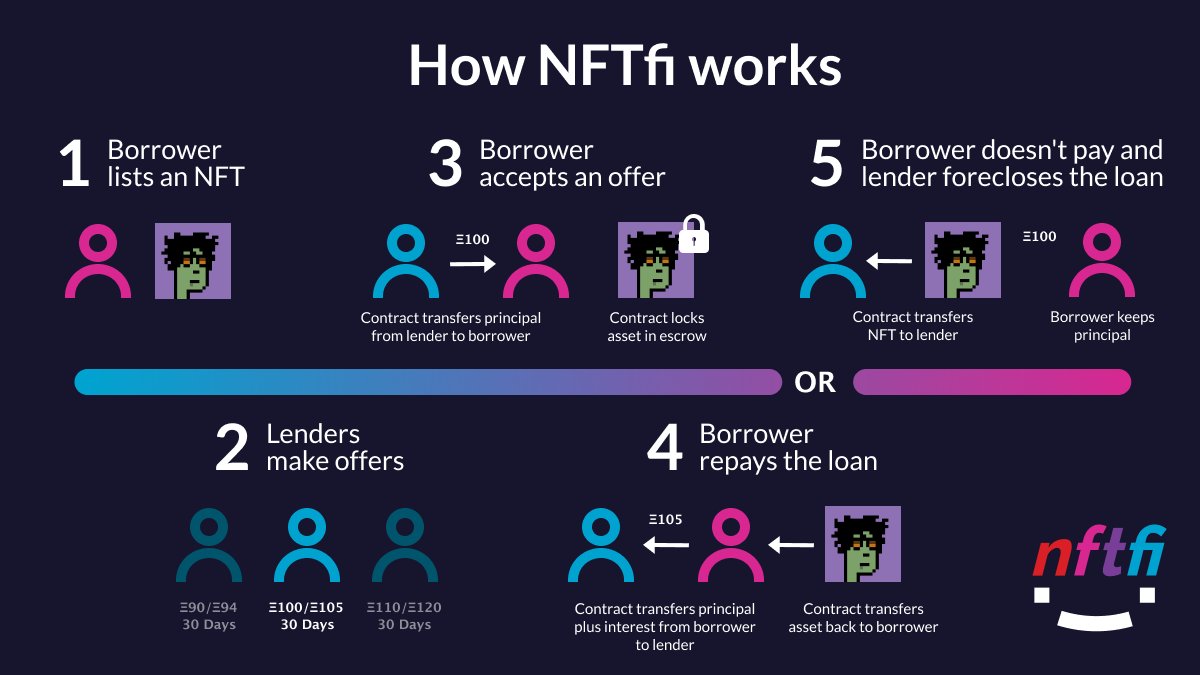

Here’s how it works: The borrower needs a loan and puts up an asset as collateral (NFT). The lender supplies the loan in exchange for interest. But if the borrower can’t repay the loan on the agreed terms, the lender will receive the collateral. In most cases, this process is autonomously executed by smart contracts on the blockchain.

But in all cases, NFT lending is executed via one of four main models, each with its own benefits and drawbacks.

Peer-to-Peer: NFT lending platforms made simple

The simplest form of NFT lending is peer-to-peer, since it closely resembles the relationship between a borrower and a lender you can find at your local bank.

Most transactions take place on peer-to-peer NFT lending platforms like NFTfi, and follow a similar process. But unlike borrowing against an asset with a stable price, NFTs are a bit more tricky. The market is incredibly volatile, which means the market value of an NFT today may be significantly different than its value down the line. So how do you appraise its current value?

The truth is, it depends. Most peer-to-peer lending platforms use a simple offer system to allow anyone to make loans and set terms without a centralized or third-party intermediary.

A user will list their NFT on the platform and receive loan offers based on the lender’s perceived collateral value of the NFT. If the borrower accepts the offer, they will immediately receive a wrapper ETH or DAI from the lender’s wallet. Simultaneously, the platform will automatically transfer the borrower’s NFT into a digital escrow vault (read: smart contract) until the loan is either repaid or expires. If the borrower defaults on the loan, the smart contract automatically transfers the NFT into the lender’s wallet.

Consolidating multiple NFTs with Arcade, and more

Other platforms like Arcade allow users to consolidate, or “wrap” multiple NFTs into a single collateralized asset. Unlike NFTfi, Arcade allows borrowers to set their desired terms and payback periods in advance, and then seek out a proper lender match through the marketplace. Once a match is discovered, the process begins.

The bottom line? Peer-to-peer lending has emerged as the most favorable option for both borrowers and lenders, mainly due to its ease of use and security. The flexibility for both parties to set terms helps to account for rare NFT traits, and the smart contract logic within the escrow process is fairly straightforward. However, it’s important to note that peer-to-peer lending may not be the quickest model, since it relies on a borrower finding a lender willing to agree to set terms mutually.

According to Richard Chen, General Partner at cryptocurrency-focused investment firm 1confirmation, peer-to-peer lending is not only the safest model, but also the most liquid and competitive on the lending side.

“If you list a CryptoPunk on NFTfi, you’ll get a dozen offers pretty quickly,” said Chen in an interview with nft now. As DeFi yields have fallen, DeFi lenders have shifted toward NFT lending, since that’s where the highest yields in crypto are right now.”

Peer-to-Pool NFT lending

As the name suggests, peer-to-pool lending allows users to borrow directly from a liquidity pool, rather than wait to find a suitable lender match. To assign value to the collateralized NFTs, peer-to-pool platforms like BendDAO use blockchain bridges (Chainlink oracles, to be specific) to obtain floor price information from OpenSea and then allow users to instantly access a set percentage of their NFTs floor price as an NFT-backed loan. The NFT is then simultaneously locked within the protocol.

When liquidation happens, it’s not based on the time of repayment. Instead, it occurs when the health factor of the loan — which is a numeric representation of safety comprised of the collateralized market value and the outstanding loan amount — falls below a certain threshold. However, the borrower has 48 hours to repay the loan and reclaim their collateral.

Meanwhile, lenders who supplied liquidity to the liquidity pool receive interest-bearing bendETH tokens, where the price is pegged one-to-one with the initial deposit.

In short, with peer-to-pool lending, you gain speed but lose flexibility. Since these platforms assign value based on floor prices, owners of rare NFTs are disadvantaged, limiting the amount of capital they can access. The market for borrowing is also much smaller. While platforms like Pine offer access to more NFT collections, BendDAO is only compatible with select blue-chip NFTs. But most crucially, there’s significantly greater platform and hacking risk, compared to peer-to-peer, said Chen.

“Given the illiquidity of NFTs, The price oracles used in peer-to-pool can be manipulated much more easily compared to other tokens,” said Chen. To him, good NFT appraisal tools like Deep NFT Value exist, but there’s “no oracle infrastructure yet, so teams are running their own centralized oracles which are prone to infrastructure hacking risk.”

Non-fungible debt positions

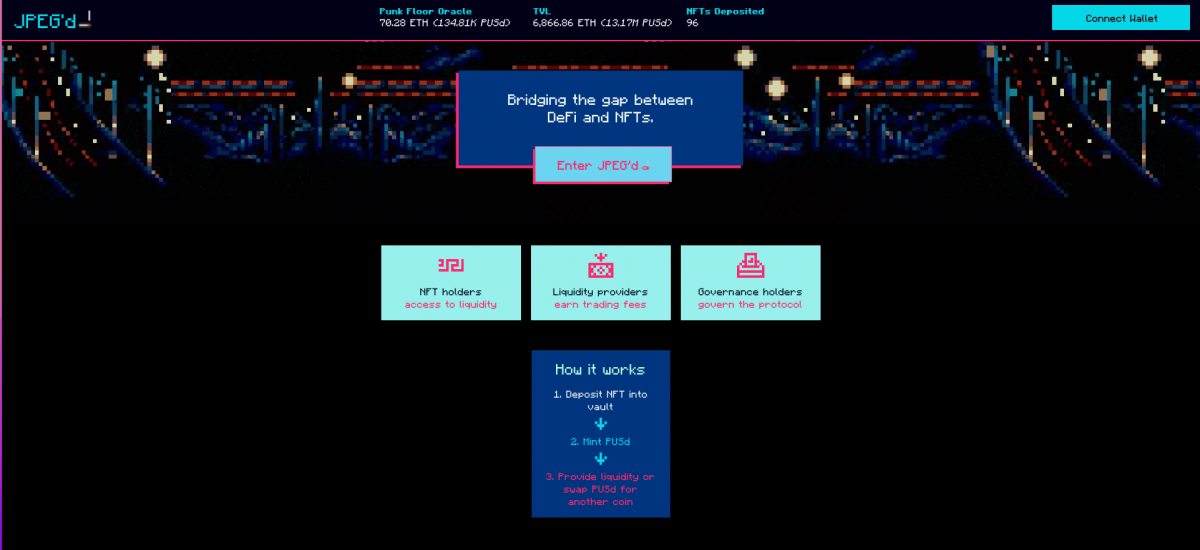

A spin-off of MakerDAO’s collateralized debt position structure, where borrowers over-collateralize ETH (a risky asset) in exchange for DAI (a less-risky stablecoin), non-fungible debt positions offer a similar deal. But on NFDP platforms like JPEG’d, instead of depositing ETH in exchange for a DAI, borrowers deposit select blue-chip NFTs and receive $PUSd, a synthetic stablecoin pegged to USD, in return.

Like peer-to-pool lending, JPEG’d uses custom chainlink oracles to fetch and maintain on-chain pricing data. The goal? To combine floor prices and sales data to price collateral in real-time with high accuracy.

Non-fungible debt positions are still very new, and will need to mature more before it’s considered a reputable lending model. Collateralized debt positions on MakerDAO are over-collateralized by 150 percent (or 1.5 times), to mitigate the volatility of ETH. NFTs are even more volatile, and the lack of need for over-collateralization raises some concern about the unpredictability of the NFT market and future liquidations. Additionally. JPEG’d is currently the only platform offering this structure, and is limited solely to CryptoPunks, so the available market is tiny, and the platform risk is quite high. All things considered, non-fungible debt positions should command close scrutiny as it unfolds.

NFT rentals and leasing via capital

Breaking rank with the other three structures, NFT renting allows NFT holders to lease out their NFTs in exchange for upfront capital. Platforms like ReNFT operate similar to peer-to-peer marketplaces, enabling renters and tenants to transact with varying rental terms and agreements without waiting for permission.

Like exchanges on NFTfi, all rental transactions are facilitated by smart contracts. But instead of a borrower sacrificing an NFT as collateral and locking it into a digital vault, the NFT is transferred to another person’s wallet for a specified period. In exchange, the “borrower” receives a lump sum of cryptocurrency. At the end of the predetermined period, the NFT is automatically returned to its owner. This is the simple form of “lending,” since there are no repayment terms, interest, or worry of liquidation.

Unlike other forms of lending where lenders are rewarded by earning interest, NFT rentals generally give lenders access and credibility. The NFT space thrives on social proof, and owning an expensive NFT can increase attention and recognition in the space. Some communities are also token-gated, where renting an NFT helps users gain exposure to people and experiences they may not otherwise acquire. Similar to renting clothing, cars, or other items of status-laden material, the emerging sector of NFT rentals is poised to become one of the most enduring ones.

Ultimately, whether NFT lending is the right decision for you specifically boils down to your time horizon and risk tolerance. Like all crypto protocols, it’s essential to do your own research and not over-leverage or invest money you’re not comfortable losing.

The post Looking for Liquidity? Here’s Everything to Know About NFT Lending appeared first on nft now.