NFTs Explained: A Must-Read Guide to Everything Non-Fungible

Non-fungible tokens — or NFTs — are causing a paradigm shift across nearly every sector of society. They’re transforming everything from finance to art, and there’s good reason to suspect that almost no corner of society will be left untouched.

If that sounds like a bit of an overstatement, know that it’s really not.

Over the last few years, NFTs have proven to be one of the most significant contemporary innovations in tech, finance, fashion, sports, and the arts. Since going mainstream in 2021, NFTs have been the source of hype, confusion, and drama (yes, drama!) as they have taken their place as the latest cultural phenomenon.

If you’re new to cryptocurrencies and digital assets, it can be difficult to wrap your head around NFTs and everything that’s happening in the space. But don’t fret. We’re here to solve all your NFT woes. Here, we give you a crash course in everything non-fungible. We cover what NFTs are, how they’re made, the various benefits and drawbacks, and how you can determine whether NFTs are right for you.

And if you’ve finished reading and there’s something you’re still confused about, you can always shoot us a message. Let’s get started.

Table of Contents

1. What’s an NFT?

2. How are NFTs different from cryptocurrency?

3. Why own NFTs?

4. How to create, buy, and sell NFTs

5. The environmental impact of NFTs

6. NFT usage and ownership rights

7. NFT scams explained

8. Taxes and NFTs

9. A brief history of NFTs

10. A timeline of innovative and popular NFTs

11. Are NFTs right for you?

What’s an NFT?

A non-fungible token (NFT) is a unique unit of data on a blockchain that can be linked to digital and physical objects to provide an immutable proof of ownership.

The data an NFT contains can be tied to digital images, songs, videos, avatars, and more. However, they can also be used to give an NFT owner access to exclusive merchandise, tickets to live or digital events, or be linked to physical assets like cars, yachts, and much more.

In this respect, NFTs allow individuals to create, buy, and sell items in an easily verifiable way using blockchain technology. But bear in mind that, unless otherwise stated, you’re not buying the copyright, intellectual property rights, or commercial rights to any underlying assets when you buy an NFT. However, all the legal details can get pretty complicated, so we’ll dive into this more in subsequent sections.

When it comes to creating and selling NFTs, the process is really rather simple. It works like this:

- An individual (or company) selects a unique asset to sell as an NFT.

- They add the object to a blockchain that supports NFTs through a process called “minting,” which creates the NFT.

- The NFT now represents that item on the blockchain, verifying proof of ownership in an immutable record.

- The NFT can be kept as part of a private collection, or it can be bought, sold, and traded using NFT marketplaces and auctions.

As you might imagine, the technical definition is a bit more convoluted. If you’re interested in that kind of breakdown, our NFT dictionary gives you a comprehensive overview of all the technology and infrastructure in the NFT ecosystem.

How are NFTs different from cryptocurrency?

Just like the money in your bank account, cryptocurrency is what you use for any and all transactions on the blockchain. Cryptocurrency can be purchased or converted into fiat currencies (dollars, euros, yen, etc.) via crypto exchanges. By contrast, an NFT is a unique and irreplaceable asset that is purchased using cryptocurrency. It can gain or lose value independent of the currency used to buy it, just like a popular trading card or a unique piece of art.

LEARN MORE: NFTs for Beginners: A Guide to Crypto Exchanges

In this respect, NFTs are non-fungible and cryptocurrencies are fungible.

To better understand this, it makes sense to think of traditional fiat currencies. If we asked you to let us borrow a dollar, you wouldn’t open your wallet and say, “Which dollar bill do you want?” Doing so would be silly, as each $1 bill represents the same thing and can be exchanged for any other $1 bill. That’s because the U.S. dollar is fungible. Cryptocurrencies are also fungible. They’re not unique and can easily be traded and replaced.

NFTs, on the other hand, are non-fungible in the sense that no two are the same. Each NFT is a unique unit of data that cannot be replaced by an identical version because there is no identical version.

When it comes to NFTs, uniqueness and scarcity increase their appeal and desirability. And as is true of all rare items, this scarcity allows individuals to sell their NFTs for premium prices.

Why own NFTs?

The demand for NFT art has exploded recently. However, there is still a lot of skepticism. After all, NFTs are generally tied to digital files. How is owning such an NFT different from a screenshot of a photo? Does “proof of ownership” mean anything? To help you decide, here are some of the main reasons why people own NFTs.

1) It empowers artists

Publishers, producers, and auction houses often strong-arm creators into contracts that don’t serve their interests. With NFTs, artists can mint and sell their work independently, allowing them to retain the IP and creative control. Artists can also earn royalties from all secondary sales of their work.

In this respect, NFTs have the potential to create fairer models by bypassing the gatekeepers that currently control creative industries, and many individuals buy NFTs because it’s a way of empowering and financially supporting the creators that they love.

2) Collectibility

Despite costing less than 5 cents to make, a 1952 Mickey Mantle rookie card sold for $5.2 million. This happened because of the history, rarity, and cultural relevance of the card. NFTs are, in many ways, the digital version of this. For individuals who want to build a collection of digital assets, NFTs offer a unique opportunity that hasn’t existed outside of traditional collectibles and art markets ever before.

3) Investment

Some NFT owners simply want an asset that will increase in value. In this respect, some collectors treat NFTs as an investment — much like traditional art. Want proof? Mike Winkelmann, a prominent American digital artist known professionally as Beeple, sold his Everydays: The First 5000 Days composite at Christie’s for $69 million in March of 2021.

This may seem strange to some, as everyone can see and interact with the image. However, as noted, there can only be one NFT owner. For some, this is enough. Yet, market volatility makes NFT investment a high risk, with the potential for major losses.

4) Community

NFT Ownership also comes with community. For many collectors, owning an NFT is a matter of identity.

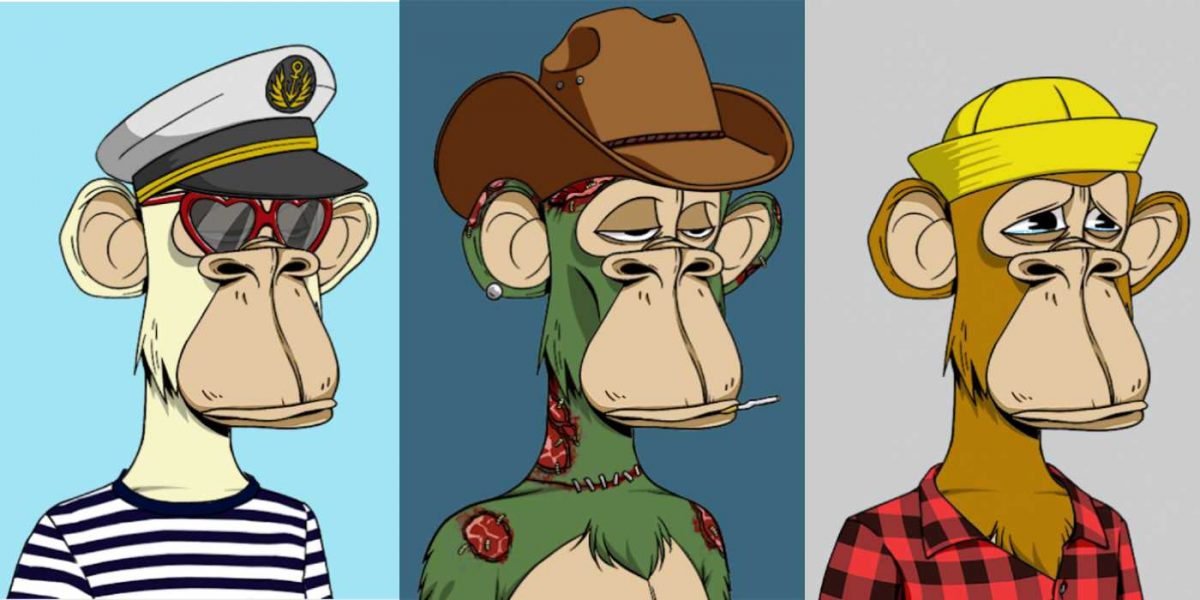

Many creators have also turned their NFT projects into vibrant communities. The Bored Ape Yacht Club is, perhaps, the best example of community building in relation to an NFT project. Collectors get access to a members-only discord, exclusive merchandise, a vote in the future of the project, tickets to virtual meetups, and more.

FURTHER READING: Should You Buy an NFT? Should Anyone?

Creating, buying, and selling NFTs

Unfortunately, wading into the NFT market isn’t as simple as it might sound. After all, you can’t exactly buy an NFT with a dollar and then carry it home with you. You’ll need cryptocurrency to fund your NFT transactions and a crypto wallet to safely store the data when you purchase (or mint) your own NFTs. And that’s just the beginning. In this section, we’ll talk about how NFTs are created, traded, stored, and managed.

So, if you’re wondering how you can get started with NFTs, this is the section for you.

Step 1 – Get a crypto wallet

In short, a crypto wallet is a physical device or computer program that allows you to store and transfer digital assets. There are two basic types of crypto wallets: software and hardware wallets. When it comes to minting and shorter-term trades, a hot wallet is the way to go. But for safety reasons, you should use a hardware wallet to store your most valuable assets.

A software wallet (also known as a “hot wallet”): This is an application that can be downloaded and installed on your device. Software wallets are more convenient and can be accessed more easily than hardware wallets, as they are always connected to the internet. However, these wallets are more open to attacks and easier to hack. As a result, they are typically seen as being less secure.

A hardware wallet (also known as a “cold wallet”): This is a physical device that is generally pretty similar to a USB stick that you might use to store files from your computer. Except that, in this case, you are storing your crypto and NFTs. Because these wallets can be completely isolated from the network, assets stored in hardware wallets are often considered to be far more secure than software wallets.

FURTHER READING: Everything You Need to Know About Crypto and NFT Wallets

Step 2 – Buy crypto

Some NFT marketplaces, like Nifty Gateway and MakersPlace, let you trade NFTs using traditional payment methods. Others, like SuperRare and OpenSea, only let people use cryptocurrency. When it comes to which crypto you should get, Ether (ETH) is the leading one used for NFT transactions. It’s the native currency of the Ethereum blockchain, and it can be purchased in a few different ways, including via major trading platforms like Coinbase and Gemini, which allow users to buy ETH with a bank account or credit card.

However, considering the high transaction costs and environmental impact associated with ETH, some want to use cryptos from other blockchains to trade NFTs. Alternatives like Solana (SOL), Tezos (XTZ), Flow (FLOW), and Binance Smart Chain (BSC) also support NFT transactions. But if you’re a beginner, it may be best to stick to ETH and the Ethereum blockchain, as it has a lot more marketplaces and users.

FURTHER READING: How to Buy and Sell Cryptocurrency in 5 Simple Steps

Step 3 – Find a marketplace

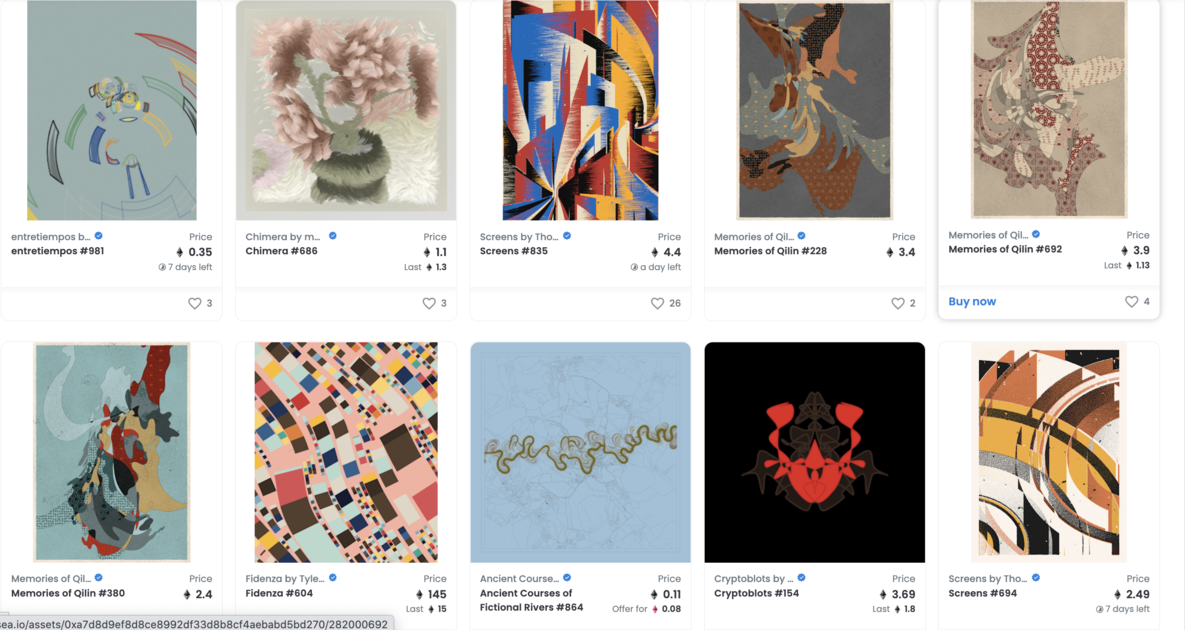

One thing to consider when choosing a marketplace is whether or not you intend to mint one NFT at a time and place it up for auction or mint a collection or batch of NFTs that are each individually priced. For the latter, consider a few of the world’s largest NFT marketplaces. OpenSea is the most popular NFT marketplace, with over 1 million active user wallets on the platform. LooksRare and Rarible are two of the most formidable OpenSea competitors.

If you intend to mint 1/1 NFTs, on the other hand, platforms like SuperRare, Foundation, and Zora are your best bet.

And do be prepared, minting comes with an initial cost. Most of the time, you’ll only need to pay a gas fee (transaction fee) to mint, but sometimes marketplaces will tack on extra costs. Similarly, make sure you do your due diligence when researching royalty splits. You are not guaranteed to have cross-platform royalties when you mint on a platform like OpenSea or Rarible. Though there are smart-contract and minting tools like CXIP that help tackle this problem and 0xSplits that help with automated royalty splits to ensure you receive secondary sales royalties no matter where your NFTs are resold.

Step 4A – Mint an NFT

New NFTs are created via a process called “minting.” This is the procedure of associating a specific set of data — the NFT — with a specific asset or object. When picking a unique asset, keep in mind that you must own the copyright and intellectual property rights for the item you want to mint. Take care with this process. If you create NFTs using assets you don’t own, you could easily end up in legal trouble.

Once you select a marketplace and create an account, you can begin the minting process. This process will be slightly different for each marketplace, but you’ll typically need to upload the file you intend to associate with your NFT and fund the transaction using ETH or another cryptocurrency, depending on what blockchain you’re using. It’s also possible to mint a physical, real-world object, but the process is more complex than what we’ll cover here.

Once the minting process is complete, you’ll have all the relevant information regarding your new NFT, and that NFT will be registered to your digital wallet. Now you can keep it, sell it, or trade it at your leisure.

Step 4B – Buy or sell NFTs

Keep in mind that some NFTs may not be available on the open marketplace or may only be purchased through specific vendors. For example, CryptoPunks have historically been sold through the Larva Labs website rather than through a public marketplace.

Once you’ve found an NFT that you’d like to purchase, you may have the opportunity to buy it outright. In other cases, you’ll need to bid on the NFT of your choice and wait until the auction closes. If you’re the top bidder after the auction closes (or if the seller accepts your bid), the transaction will complete and ownership of the NFT will transfer to your wallet.

At that point, you now own the NFT and can buy, sell, or display it as you see fit.

READ MORE: How to Display NFT Art: A Guide to NFT Displays

Selling your NFT follows a similar process as outlined above. You’ll need to set up the auction on the marketplace of your choice. Take the time to understand all the fees and different kinds of auction methods available to you before initiating the sale. Once the auction is complete, the NFT will be automatically transferred from your possession and the proceeds from the transaction will be transferred to you.

The environmental impact of NFTs

Of course, the NFT boom isn’t without its downsides. One of the most frequent criticisms that comes up relates to the energy that’s needed to operate a massive blockchain network like Ethereum. This blockchain consumes more electricity than many countries. Many argue that NFTs contribute to blockchain’s overall carbon footprint because they promote the use of the technology.

However, in reality, even if everyone stopped using NFTs tomorrow, blockchain would continue to use the same amount of energy. That’s because transactions don’t actually increase the energy consumption of the network. Why? Because blockchains keep running at the same speed and with the same energy consumption regardless of whether or not there are any transactions to be filled.

And even if this weren’t the case, numerous other technologies have similar energy needs. In fact, YouTube and Ethereum have roughly the same carbon footprint. That’s not an excuse regarding blockchains and the carbon footprint they leave behind, but it’s important to understand the issue in its proper context.

What’s more, some blockchains are already moving to solve the blockchain energy problem. For example, Solana uses a unique combination of proof-of-history (PoH) and Proof-of-Stake (PoS) mechanisms to substantially reduce energy use. And the Liquid Proof-of-Stake (LPoS) mechanism employed by Tezos uses about two million times less energy than Ethereum.

READ MORE: NFTs and the Environment: Why the Anger Is Unjustified

NFT usage and ownership rights

NFTs have a nuanced relationship with the assets tied to them. While an NFT is designed to represent the original asset on the blockchain, the NFT itself is seen as a separate entity from any content it contains. Throughout this article, we’ve often compared NFTs to trading cards, and that analogy holds true here as well.

Say you own a vintage baseball card or a popular trading card from a collectible card game, like Magic: The Gathering. You own a representation of the original work — but you don’t own the original work itself. The copyright for the artwork, design, and branding of the card you possess are wholly owned by the card’s manufacturer.

In the same way, while NFTs represent an item on the blockchain, ownership of an NFT does not transfer the intellectual property or usage rights of that original work to you.

For example, let’s say you buy an NFT that contains the very first digital copy of Harry Potter and Sorcerer’s Stone. You own the NFT. But that doesn’t mean you have the right to sell Harry Potter merchandise, make Harry Potter movies, or give others permission to use the Harry Potter IP for commercial purposes.

Sadly, NFT ownership and usage rights are often conflated, which has given rise to some buyers purchasing NFTs with the mistaken understanding that an NFT effectively gives them the rights to expand upon (and capitalized from) well-established IPs.

Of course, there are some exceptions to these hard and fast rules. Bored Ape Yacht Club has stated publicly that all BAYC NFT owners have full commercial rights to that Ape. It can be monetized however the NFT owner sees fit to do so. Some projects like CrypToadz and Nouns have taken this even further by releasing their IP to the public domain under Creative Commons (known as CC0). But they should be viewed as the exception, not the rule.

Copyrighted content

Using self-minting platforms like OpenSea, it’s possible for any user to mint a new NFT using copyrighted content that they don’t own. This is dangerous for the minter, buyers, and the original artist for a few reasons:

- By profiting off of illegitimate content, sellers and buyers open themselves up to legal action by the legitimate copyright holders.

- Legitimate NFTs issued by the copyright holder may be devalued by illegitimate NFTs of the same work.

- Buyers may not know that the content they’ve purchased is illegitimate or that they’ve put themselves in legal jeopardy with an illegitimate trade.

Concerns around legitimacy are one of the reasons that verified NFT projects and accounts are preferable. To stay safe on NFT marketplaces, always look for verified projects on platforms, and only follow links from official (and verified) user accounts on social media.

In the case of sales that take place via official websites, like with Art Blocks or NBA Top Shot, buyers can act with confidence knowing that their NFT comes from a legitimate source.

NFT scams explained

NFTs are still a new phenomenon. As a result, the market is vulnerable to scams that can take advantage of unsuspecting collectors. Here are a few scams and problems with the NFT market that you should watch out for.

FURTHER READING: How to Identify and Avoid NFT Scams

Rug pulls

Even though large generative projects are preferred by collectors, there’s not always safety in numbers, and no NFT project is entirely without risk. In fact, many projects have fallen apart due to rug pull scams. A rug pull occurs when the project creators take the investment money for the project and disappear. By absconding with all of the money, the team leaves collectors with a valueless asset.

Notably, these kinds of rug pulls often aren’t illegal. Are they unethical? Sure. But if a project promises to donate funds and then chooses to keep the money, there isn’t much that anyone can do. In rare instances, a rug pull may count as fraud, but this often isn’t the case.

Rug pulls can also happen when NFT developers remove the ability for investors to sell their tokens. These kinds of rug pulls are illegal, and you may be able to recoup your money. However, it will probably cost you a lengthy court battle. Additionally, many NFT creators don’t use their legal names, so it may be difficult (or even impossible) to track them down.

FURTHER READING: What Are Rug Pulls? Are They a Crime?

Wash trading

As with stocks and other collectibles, market manipulation can happen during NFT auctions.

Working together, a group of potential buyers can drive up the price of an NFT by artificially inflating the bid price until an unsuspecting buyer joins the fray. After the sale, the asset deflates in value, leaving the buyer with a valueless NFT. One of the most common ways of doing this with NFTs is with wash trading. Wash trading occurs when a user controls both sides of an NFT trade, selling the NFT from one wallet and purchasing it from another.

When many transactions like this are executed, the trade volume rises. As a result, it looks like the underlying asset is highly sought after. This has the effect of increasing the value (the price) of the NFT in question. In fact, some NFT wash traders have executed hundreds of transactions through self-controlled wallets to try and increase demand.

FURTHER READING: What is a “wash trade” in NFTs?

Phishing scams

Whether through fake advertisements, NFT giveaways, or some other form of coercion, scammers will sometimes ask for your private wallet keys and/or other sensitive information like your seed phrase.

Depending on what information they get access to, the scammer can then access your wallet and remove any cryptocurrency or NFTs stored within or sign transactions without your consent. Because blockchain is decentralized and often anonymous (i.e. there’s no regulatory authority and individuals don’t have submit proof of identity to use it) there’s generally no way to recover your assets if this happens.

Just like password phishing emails, these scams come in all stripes, and they can be very hard to spot if you aren’t looking for them. As a reminder: Never share your seed phrase or private keys with anyone or they will be able to access your funds, and only follow links from official websites and accounts.

Sometimes, even that’s not safe…

Taxes and NFTs

Tax responsibilities will vary by country, but due to the trading value for most NFTs, acquiring a large sum of money in this way is likely to be considered capital gains. If you’re an NFT creator — meaning that you’ve minted and sold your own NFTs — that income is likely to be considered some form of business income, and you’ll need to claim it when filing your tax returns.

The specifics will vary based on the legalities within your region, but NFTs are not a tax-free investment. Be careful if you plan to treat them as such.

FURTHER READING: 6 Critical Things to Know About NFTs and Taxes

But what about crypto philanthropy? We’ve seen a sharp rise in “intentional charitable donations” made via NFTs in recent years. The geopolitical crisis in Ukraine stands as a perfect example of how NFTs can be used to positively impact communities in need.

In fact, more than 1,300 nonprofits accepted crypto-based donations in 2021, which are considered tax-deductible in the U.S., among other countries. Meaning that taxpayers can get a tax-deductible write-off for donations they made in crypto or NFTs. But again, this will vary from country to country.

FURTHER READING: NFTs and Charity: What to Know About Deductions and Tax Hurdles

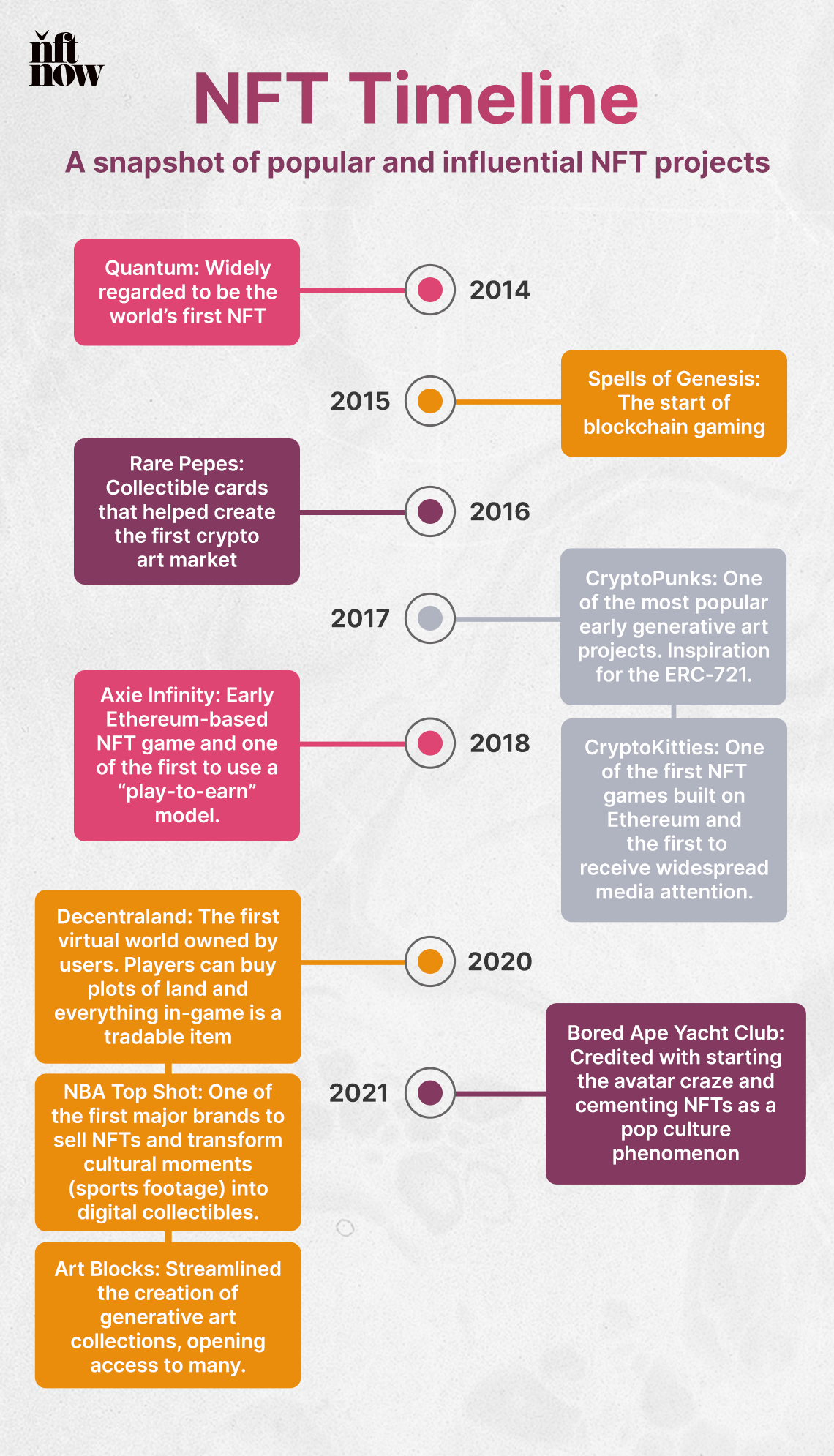

A brief history of NFTs

The first NFTs

The first NFT ever created is called “Quantum.” It was minted by Kevin McCoy on Namecoin in 2014. Several other NFTs were launched on pre-Ethereum blockchains over the following years. For example, Spells of Genesis launched in 2015 and stands as the first-ever blockchain-based game. Rare Pepes came out in 2016 and helped kick off the first crypto art market.

However, these projects failed to reach widespread popularity. They remained mostly unknown to all but those who were well-versed in cryptocurrency and blockchain technologies.

For typical consumers, NFTs only began to gain mainstream momentum in 2017. Around this time, the first NFT collections were launched on the Ethereum blockchain. Previous blockchains made trading and transferring ownership impressively difficult. The Ethereum network and its smart contracts functionality enabled token creation, programming, storage, and trading built directly into the blockchain itself. These new features eased the onboarding process and increased access.

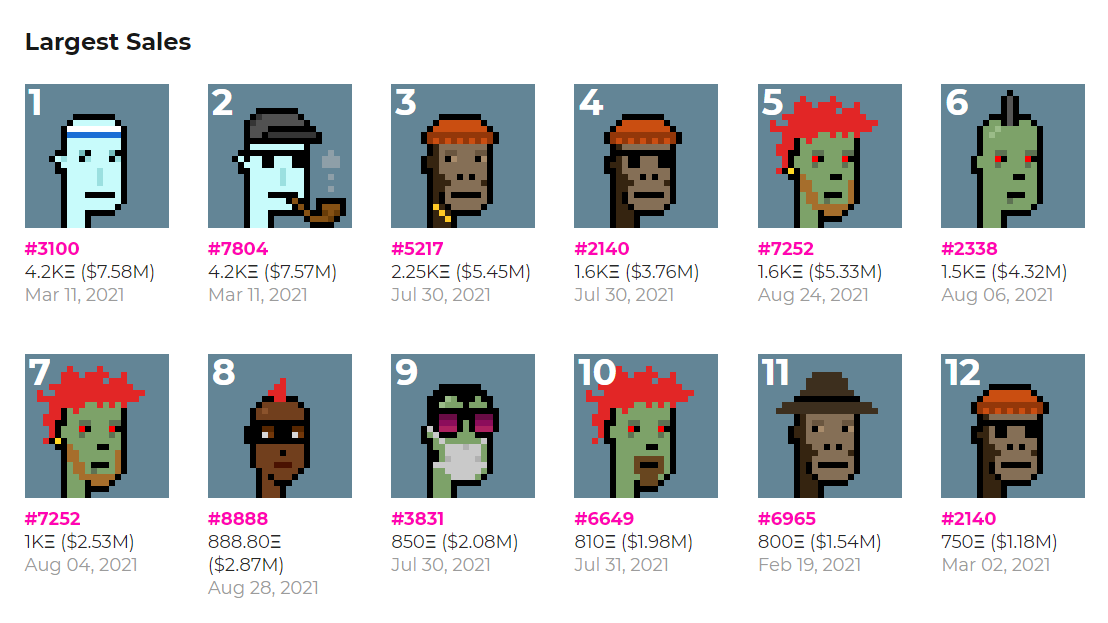

One of these earliest Ethereum projects was CryptoPunks, a collection launched by Larva Labs that has become synonymous with early NFT history. As a result, many of its individual pieces have sold for millions.

READ MORE: Top 10 Historical NFTs Everyone Should Know

NFT interest soars

Prior to 2021, two catalysts arguably helped increase price points and speed public interest along. The first was the COVID-19 pandemic, which forced many people to be more digitally native and connect with each other on platforms like Twitter and Clubhouse, where the NFT community has built a strong presence.

The second was Beeple. The longtime artist turned into an NFT pioneer when he became the first creator to sell an NFT with a major auction house. When the Christie’s auction for his “Everydays — The First 5000 Days” came to a close on March 11 at an eye-popping $69 million, NFTs could no longer be ignored.

The sale made headlines in papers around the world, and more sales soon followed. Edward Snowden’s piece, Stay Free, sold for $5 million in April. In June, CryptoPunk #7523 sold for $11 million. In December, XCopy’s “Right-click and Save As Guy” sold for $7 million.

While digital art and collectibles largely propelled 2021’s boom, there are countless additional applications of NFT technology that also launched around this time and drew attention to the space. There are NFT-based virtual worlds, such as Decentraland and CryptoVoxels, and NFT-based blockchain games like Axie Infinity and Zed Run.

As adoption has increased, so have the sales volumes and price points. This led to an explosion of interest from companies and brands looking to launch their own NFT projects and capitalize on market growth. Companies like Coca-Cola and Taco Bell have created NFTs around popular food and beverage products. Other brands, like Hot Wheels and Adidas, have begun selling NFTs connected to their physical products. There are even reports of NFT collections by brands like Gucci selling for far more than the price of their flagship product!

READ MORE: Moving Mainstream: How Big Brands Are Using NFTs

The future of NFTs

Right now, NFTs are still in their infancy. With the possible applications of the technology seemingly limitless, it’s anyone’s guess where NFTs go from here.

It’s been widely speculated that NFTs could play some role in the metaverse of the future, mainly by acting as a digital representation of the physical objects you possess. This could also happen with your digital avatar. If NFTs are used to represent items in a video game on a unified blockchain, items and skins can be moved between all games using that blockchain.

However, some skeptics argue that NFTs don’t really have a future. Rather, they say they are merely a passing fad and may ultimately be relegated to a niche part of a larger market, similar to the trajectory with collectible card games and other vintage collectibles.

What vision of the future is accurate? It’s honestly hard to say. Given how young NFTs are at the moment, the only way to know for sure is to wait and see. Where NFTs stand now is likely to look vastly different within a short period of time.

A timeline of innovative and popular NFTs

In this section, we’ll cover some of the most notable NFT projects to date. But be warned — this list is far from exhaustive. So be sure to check out our resources on historical NFTs for a more in-depth blast from the past.

Quantum (2014)

As noted, the world’s first NFT was minted by Kevin McCoy on Namecoin in 2014. It’s called “Quantum,” and it was sold in 2021 via Sotheby’s for $1.47 million. This led to a subsequent lawsuit due to ownership disputes.

Problems arose because McCoy originally minted “Quantum” on NameCoin, which is blockchain software modeled from Bitcoin’s code. NameCoin registrations must be renewed regularly, but McCor failed to renew it in 2015.

Unfortunately, another party with the Twitter handle @EarlyNFT registered as the owner of the NFT ahead of McCoy’s 2021 sale. The contents of the 2014 blockchain entry include the statement, “I assert title to the file at the URL http://static.mccoyspace.com/gifs/quantum.gif.” And “Title transfers to whoever controls this blockchain entry.” This seems to indicate that the Twitter user may, in fact, be the rightful owner – not McCoy.

However, given that NFTs are largely unregulated, it remains to be seen exactly how this will play out from a legal perspective.

Spells of Genesis (March 2015)

Spells of Genesis was created in 2015 by EverdreamSoft on top of Bitcoin. It’s the very first blockchain trading card game. As such, it helped usher in a new era of gaming – one in which players have true ownership of their digital assets.

Each card contains a piece of art representing a historic moment in blockchain history. Players collect, trade, and combine cards to create a powerful deck. Once this is done, they can challenge various opponents.

Rare Pepe (September 2016)

The Rare Pepes tokens are digital collectible cards that were minted by blockchain pioneers in 2016. The first Rare Pepes were mined in block 428,919 in September of 2016. They stand as one of the first art experiments on the blockchain, helping spawn the early crypto art movement.

The Rare Pepe Wallet was created by developer Joe Looney shortly after. It’s a web-based, encrypted wallet that runs on Counterparty. It lets users trade and destroy their Rare Pepes.

The tokens were initially traded almost exclusively on Counterparty. However, after NFT sales started to skyrocket in 2021, some Rare Pepe owners used a software protocol called Emblem Vault to reconfigure their tokens to run on the Ethereum blockchain. Many of these were then listed and sold on OpenSea for hundreds of thousands of dollars.

Out of the nearly 1,800 cards issued across 36 series, the Series 1, Card 1 is the rarest and most valuable. It pays homage to Satoshi Nakamoto, the person or group that created Bitcoin. It’s called the Nakamoto Card, and holding one (there are only 300 total) is the only way to gain entry into the 300 Club.

CryptoPunks (June 2017)

CryptoPunks first hit the market in 2017 and was launched by product studio Larva Labs. The project was one of the earliest NFT generative art collections ever launched, and it directly inspired the current crop of popular generative PFP projects, like Bored Ape Yacht Club. In this respect, it’s one of the most influential NFT projects of all time.

Each Punk is algorithmically generated and entirely unique, with some characteristics rarer than others.

To date, CryptoPunks is still one of the most sought-after NFT collectibles, and any NFT from the collection is considered a rare and exclusive item in the community. The Punks themselves typically go for hundreds of thousands, with some trades easily climbing into the millions.

FURTHER READING: A Guide to CryptoPunks NFTs

And it’s not just collectors that are after these valuable NFTs. Some companies, like Visa, have also purchased Punks in the past, which has further driven up scarcity and demand among NFT aficionados.

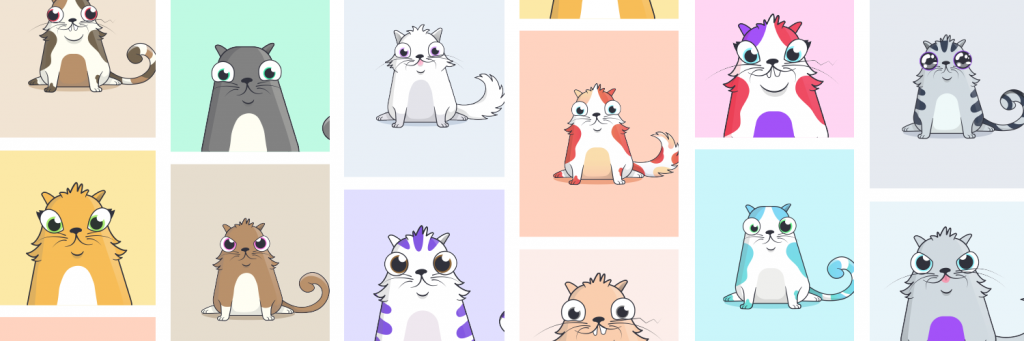

CryptoKitties (November 2017)

CryptoKitties was created by Canadian studio Dapper Labs and launched in 2017. It’s one of the first blockchain games to be built on Ethereum, and it was the first project to receive widespread media attention. It was also the inspiration for ERC-721, an open standard that describes how to build NFTs on Ethereum virtual machine (EVM) compatible blockchains.

CryptoKitties is a collectible game where players purchase, breed, and trade virtual cats. Each cat is assigned 12 unique traits, including fur patterns, accent colors, eye shape, and nose shape. The attributes have varying levels of rarity, and attributes are designed to be passed down through the breeding mechanics of the game. Each cat is 100% unique.

Of course, breeding your CryptoKitties isn’t free. You’ll need to spend ETH on the platform to trade and breed your cats. However, because you can effectively generate new assets via breeding and then sell that new NFT on the open market, the game comes with a unique appeal for many prospective gamers.

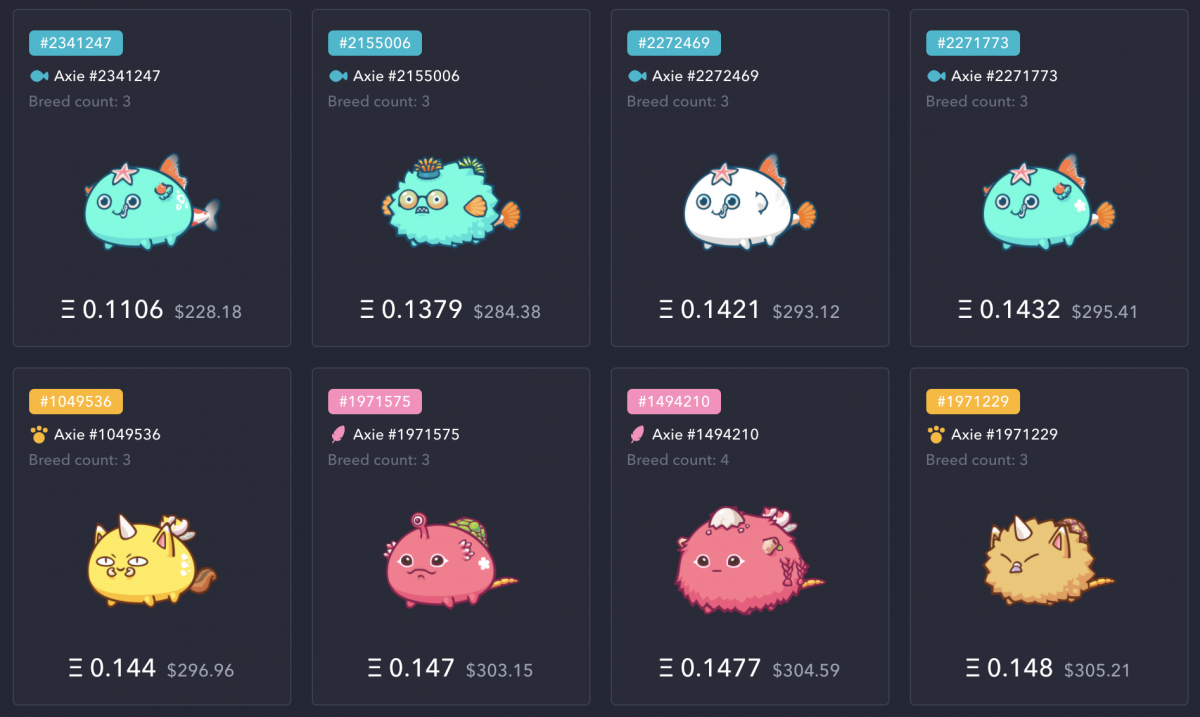

Axie Infinity (March 2018)

One of the first blockchain games, Axie Infinity is an online video game based around NFTs and Ethereum. It was created by Vietnamese studio Sky Mavis. Players collect creatures called Axies, and then they use them to fight, build, and achieve victory within the game. The platform also features a marketplace where individuals can sell game items and Axies to other players.

First launched in 2018, Axie uses a “play-to-earn” model, meaning that users can earn in-game cryptocurrency simply by playing. This is an innovative approach that you won’t see with too many other NFTs, as it effectively allows Axie users to increase their overall market value by engaging with the game.

However, the game isn’t without its faults. Some have likened the game’s payout system to gambling, and the buy-in price for new players has dropped dramatically in recent years.

Decentraland (February 2020)

Decentraland is a browser-based game where users can buy and sell virtual plots of land and in-game items. It was created by Argentinians Ari Meilich and Esteban Ordano, who began working on the project in 2015. It went live in 2020, and it’s currently run by the nonprofit Decentraland Foundation.

Everything in the game is a sellable item. This includes avatar wearables, estates, and the land on which these estates sit. This is a unique change of pace for NFT ownership, as it transforms digital collections into interactive objects that have a function and value – they aren’t just units of data sitting on a blockchain. Additionally, it stands as the first virtual world owned by users.

Along with virtual world CryptoVoxels, Decentraland is often cited as one of the earliest demonstrable models for the metaverse.

Admittedly, the game itself has been plagued by subpar development, poor reviews, and lower player counts for years. However, that hasn’t stopped big brands and celebrities from buying their virtual plots and setting up shop on the platform. Though the game has seen technical improvements recently, it’s safe to say that Decentraland is an ambitious undertaking that may be limited by the browser technology it relies on to be truly immersive. That said, some speculators believe that the game could take the market by storm – if it can overcome its own technical hurdles.

NBA Top Shot (October 2020)

One of the more popular NFT collections on the market is NBA Top Shot. The NFT project lets sports fans own a piece of the game they love. This collection is one of the first to transform cultural moments – via sports footage – into digital collectibles.

And thanks to the prominence of the NBA brand, the project helped drive mainstream awareness for blockchain and NFTs as few things could. For any doubters out there, the numbers largely speak for themselves. In 2021 alone, the virtual platform had more than 1.1 million registered users who traded some $800 million in NFTs.

FURTHER READING: NBA Top Shot: The Ultimate Guide

Top Shot allows users to purchase NFTs created using video clips of their favorite players and key basketball moments. The clips are cut and numbered in a series, and multiple copies are minted to create varying levels of rarity.

Compared with most of the other popular NFTs, Top Shot remains one of the most affordable NFTs for starting collectors, with most selling for well under $100 upon release and purchasable through standard fiat currencies.

Art Blocks (November 2020)

Art Blocks launched in 2020 and dramatically streamlined the creation of generative art. If you’re looking for truly unique NFTs, Art Blocks can help you flesh out your NFT portfolio in interesting (and remarkably fast!) ways. It uses generative scripts to create unique works of computer-generated art. Simply select a project that you like, and then mint an NFT from that collection. Your result will be randomly generated on demand, so you won’t know exactly what your NFT will look like until you make the purchase.

FURTHER READING: 5 Generative Art and Music Projects You Need to Know

As you’d see with a traditional art gallery, the collections that Art Blocks provide are often curated and have a high standard for uniqueness and NFT individuality. Art Blocks also collaborates with coding creatives from around the world to create its Curated Galleries, which are designed to offer the best of the best in digitally generated NFT artwork.

Bored Ape Yacht Club (April 2021)

A wildly popular PFP NFT, Bored Ape Yacht Club has received massive critical acclaim since its founding. It was created by product studio Yuga Labs. The collection features 10,000 unique NFTs, and NFT holders have full commercialization rights to the Ape that they own.

With most Ape sales going for hundreds of thousands of dollars, this NFT collection is considered one of the most prominent and profitable examples of the medium. Bored Ape also played a major role in kicking off the avatar craze (using NFTs as profile pictures). In many ways, it’s directly responsible for cementing NFTs as a pop culture phenomenon.

FURTHER READING: A Guide to Bored Ape Yacht Club

However, the art behind the BAYC NFTs isn’t exactly what started the Bored Ape craze. The status and prestige of owning one of these highly valued NFTs greatly increases their value and demand. In this respect, the community aspect is key to the brand’s success – and it certainly helps that a number of prominent celebrities are members of the BAYC community.

Ultimately, owning a BAYC NFT is the price of admission to the Bored Ape Yacht Club community. Once in, owners get access to exclusive merchandise, live events, voting rights, and more.

Other interesting NFTs

Occasionally, you’ll also find other odd NFTs floating around in the metaverse. These may not be attached to any particular project, but their cultural significance or quirkiness make them worth noting. For example…

- Classic internet memes like Nyan Cat and Bad Luck Brian sold as NFTs, and many other memes have followed suit. This enabled the artists behind the creations to finally be properly compensated and recognized for their work.

- Some of the world’s most significant, real-life cultural events have been turned into NFTs and sold for millions. For example, Twitter founder Jack Dorsey’s first tweet and Tim Berners-Lee’s original source code for the world wide web were both auctioned off.

- In 2021, record label LuckyMe pushed the music art space (and NFTs) forward dramatically when one of their hallmark artists — electronic sensation Jacques Greene — auctioned off the publishing rights to one of his singles in perpetuity.

- A host of major brands, like Lamborghini, Coachella, Time, and Instagram started launching NFT projects and exploring innovative ways non-fungibles can be incorporated into their business models and overall missions.

In all likelihood, we’ll continue to see more quirky and innovative NFT uses, as brands and independent creators push the boundaries of the collectibles market even further in the years to come.

READ MORE: Unique and Weird Ways People Are Using NFTs

Are NFTs right for you?

So far, we’ve given you everything you need to better understand NFTs, how they operate in the market, the benefits and risks, and how to get started with them.

But are NFTs right for you?

It’s a hard question to answer. In the end, it really just comes down to your personal preference and why you want to get involved in the first place. But here’s what we can tell you:

- NFTs are perfect for hobbyist collectors who want to support a content creator, be part of a community, or own a little piece of something they’re passionate about.

- As an investment opportunity, NFTs are highly volatile and the market is speculative. As with art and other rare items, some NFTs have gained immense value over time while others have lost immense value.

- The value of community for NFTs can’t be understated. From Bored Ape Yacht Club and CryptoPunks to buying NFTs from your favorite brand or artist, NFTs can be a gateway to a different community and lifestyle.

- Despite the explosive popularity we’ve seen in the past few years, NFTs are still in their early stages, and it’s never too late to get started. You definitely didn’t miss the boat.

If you do decide to get into the NFT ecosystem, we hope you enjoy the ride – we know that we certainly have.

Do you still have questions about NFTs? Feel free to shoot us a message!

The post NFTs Explained: A Must-Read Guide to Everything Non-Fungible appeared first on nft now.

There is no mint going on today. It looks like BAYC Instagram was hacked. Do not mint anything, click links, or link your wallet to anything.

There is no mint going on today. It looks like BAYC Instagram was hacked. Do not mint anything, click links, or link your wallet to anything.