Is the Potential Recession Already Impacting Consumer Spending Habits? [New Data + Takeaways for Marketers]

If you’ve watched the news recently, it seems that the possibility of a recession has captured everyone’s attention.

Americans have already seen signs like the inflation of rent, gas prices, groceries, and other necessities that pre-existing wages can’t meet. But, still, some experts say that we could still avert a recession – and if we don’t – a recession might not last as long as 2008’s.

With all these changes and newsbites in mind, business decision-makers might wonder how their potential customers are reacting. And, if their spending habits could be changing in the near future as a result?

While we don’t know if we’ll head into a recession, this post aims to help brands and marketers prepare to continue to meet consumers where they are – even in uncertain times.

To give readers insight on how spending behaviors are or could be shifting, we surveyed more than 200 U.S. consumers across all age groups.

Before we dive in, we’ll briefly explain the concept of a recession:

Recessions are a normal part of the business cycle and can be induced by global economic shocks, changes in consumer confidence, and other large-scale economic changes.

But this year, in particular, there are a select few factors that have spurred concern about a potential recession, although one still hasn’t been declared or confirmed.

For more on the cause of recessions and why some are concerned about them happening in the near future, check out this helpful post from our partners at The Hustle.

How Consumer Spending Habits Could be Changing

We conducted a Glimpse survey of U.S. consumers to understand how they spend their money and how financial uncertainties like recession could affect them. Here’s how they responded to our questions:

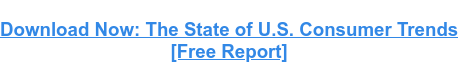

1. How has the news of a potential US recession impacted your spending habits?

Although a recession is not yet certain, most respondents are purchasing less and spending money more concisely than they were in previous months.

Rising costs of goods and services often cause consumers to become more cautious in frivolous spending, and we’re sure Americans are feeling the effects arise quickly.

As a marketer or brand leader, now might be a good time to consider discounts, sales, deals, or freemium marketing. While people are potentially tightening their wallets, they still might purchase items, services or experiences that are affordable or provide bang for their buck.

How Spending Could Change In a Recession

When thinking about consumer spending behavior, it’s often contingent on outside factors, and news of immense changes in the economy is worth looking into. Below is the distribution of varying consumer decisions and how they’d respond to financial uncertainty or a potential recession in the future.

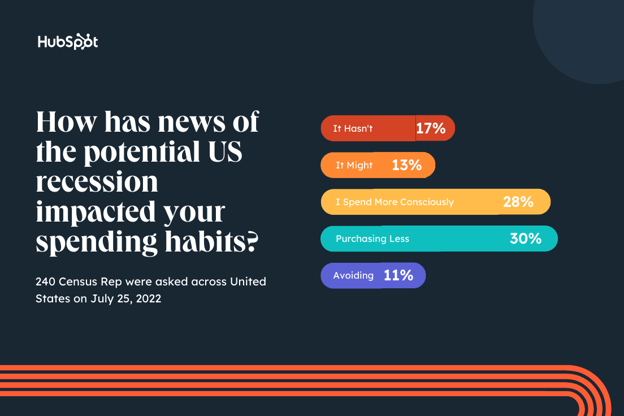

2. If a recession is declared, how will your home budget change in the first three months of this new financial era?

Unsurprisingly, most consumers polled (64%) say they’d decrease or continue to decrease their home budget if a recession was declared.

As of June, inflation hit 9.1%, a historic new peak by the Federal Reserve. But, wages aren’t moving to match these increasingly fast changes. Naturally, the public is already looking for ways to avoid breaking the bank — by reducing their budgets.

If you market B2C brands, or products that would be used specifically in the home, this is important to keep in mind if financial uncertainty continues. While you shouldn’t panic and change your whole marketing strategy over just one small survey, you might want to consider strategies like marketing your most affordable, discounted, or essential products over higher-priced or luxury items.

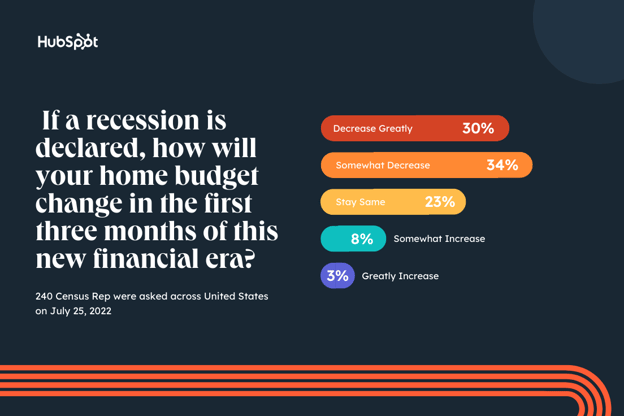

3. During uncertain financial times, what did you spend the most money on?

We also asked consumers to reflect on their purchasing behavior in previous economic eras with the question, “During uncertain financial times (such as past recessions or during the COVID-19 pandemic), what did you spend the most money on?”

When surveyed, the most prominent goods consumers have bought in uncertain times are typically considered basic necessities.

- Essential Groceries and Food

- Rent, Mortgage, Housing Bills

- Essential Personal Care Products

- Medication and Healthcare

The data reflects a shift to self-preservation and less on shopping for pleasure or taking on risks comes as no surprise. By eliminating costs for leisure or entertainment, people can ensure their families are taken care of before taking their dollar to do things like start a business, take a stroll to the movies, or invest in an unpredictable market.

The good news? This doesn’t necessarily mean there will be a complete pause in retail, entertainment, or other non-essential services. More than 10% still plan to invest in digital or online entertainment, around 7% would still invest in restaurants and bar outings – as well as education and academics, and over 16% would invest in clothing and apparel, So, unlike the pandemic, we probably won’t see entire economies close up completely for months at a time.

How an Upcoming Recession Could Differ from 2008

There are a few key differences between this recession and that of 2008, mainly in the factors that caused it and its projected duration.

According to Morgan Stanley, the possible recession would be largely pandemic-induced and credit-driven.

COVID-related fiscal and monetary stimulus contributed to inflation and drove speculation in financial assets. This is very different from the Great Recession of 2008.

The 2008 recession was due to debt-related excesses built up in housing infrastructure, which took the economy nearly a decade to absorb. By contrast, excess liquidity, not debt, is the most likely catalyst for a recession today.

Due to the difference in causes, experts at IMF predict a new recession could be short and shallow.

Key Takeaways for Businesses in 2022

As marketers, we’re not experts in financial markets and shouldn’t be seen as a source for investment, HR, and legal advice. And, no one ever knows for certain if or when there will be a recession.

It’s also to keep in mind that, while the results above can certainly help you navigate how to market your brand, they’re just a portion of one small survey and a brief look into the eyes of consumers. Before making any major decisions about your marketing department, spend, or business, you absolutely should do your research, analyze multiple data points, and consult experts in your industry.

While your decisions should be based on a deep dive of data, the survey results above do show that marketers should be cautious about how their efforts might need to pivot with changing consumer needs or trends.

Here are a few takeaways to keep in mind.

- A recession today might not be the same as 2008. While consumers likely will tighten budgets and look for products that offer the most value or necessity for their dollar, they might not be in detrimental financial conditions. They could still be persuaded to buy a great product that’s marketed to them in the coming months.

- Market your product’s affordability, value, and/or necessity: As consumers and businesses tighten their budgets, making sales, retaining customers, and persuading people to buy non-essential products will be more difficult. Make sure you are marketing that your product has added value or importance, other than being flashy, trendy, or cool.

- Marketers might want to explore more cost-effective strategies. (Think reducing excess ad spend and focusing on organic social, SEO, or email marketing instead.)

Remember, financial uncertainties – and even recessions – are common. And while it might become more challenging to win customers in the coming months, business and consumers will still keep moving (and making purchases) even as we wait for the cycle to run its course.

![]()